tHE AI Platform tHAT Transforms your Revenue GROWTH

Engage customers, forecast accurately, and improve team productivity, all in one revenue intelligence platform.

The world’s leading companies power their revenue workflows with Gong

Team Productivity

Revenue Predictability

Pipeline Growth

Team Productivity

Revenue Predictability

Pipeline Growth

10x sales efficiency

Save time and maximize team effectiveness with AI-powered insights and guidance.

10x sales efficiency

Save time and maximize team effectiveness with AI-powered insights and guidance.

95% forecast accuracy

Deliver a strong quarter every quarter with AI that powers precise pipeline management and accurate forecasts.

80% increase in

email response rate

Create, accelerate, and close pipeline with customer-centric sales engagement.

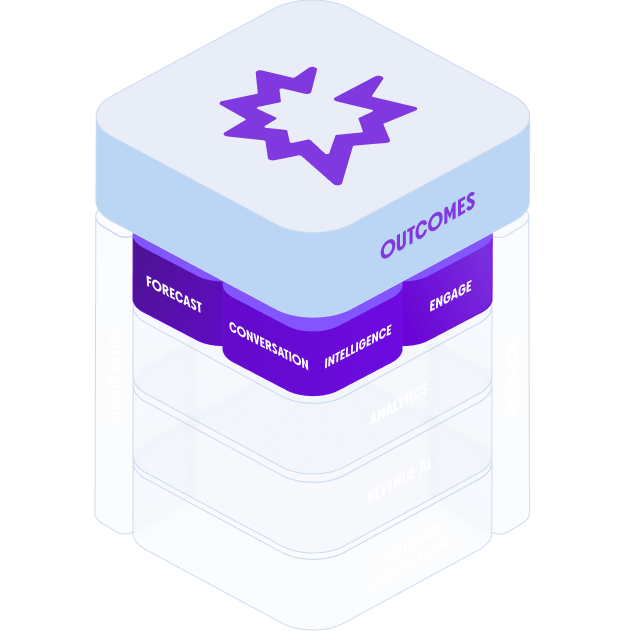

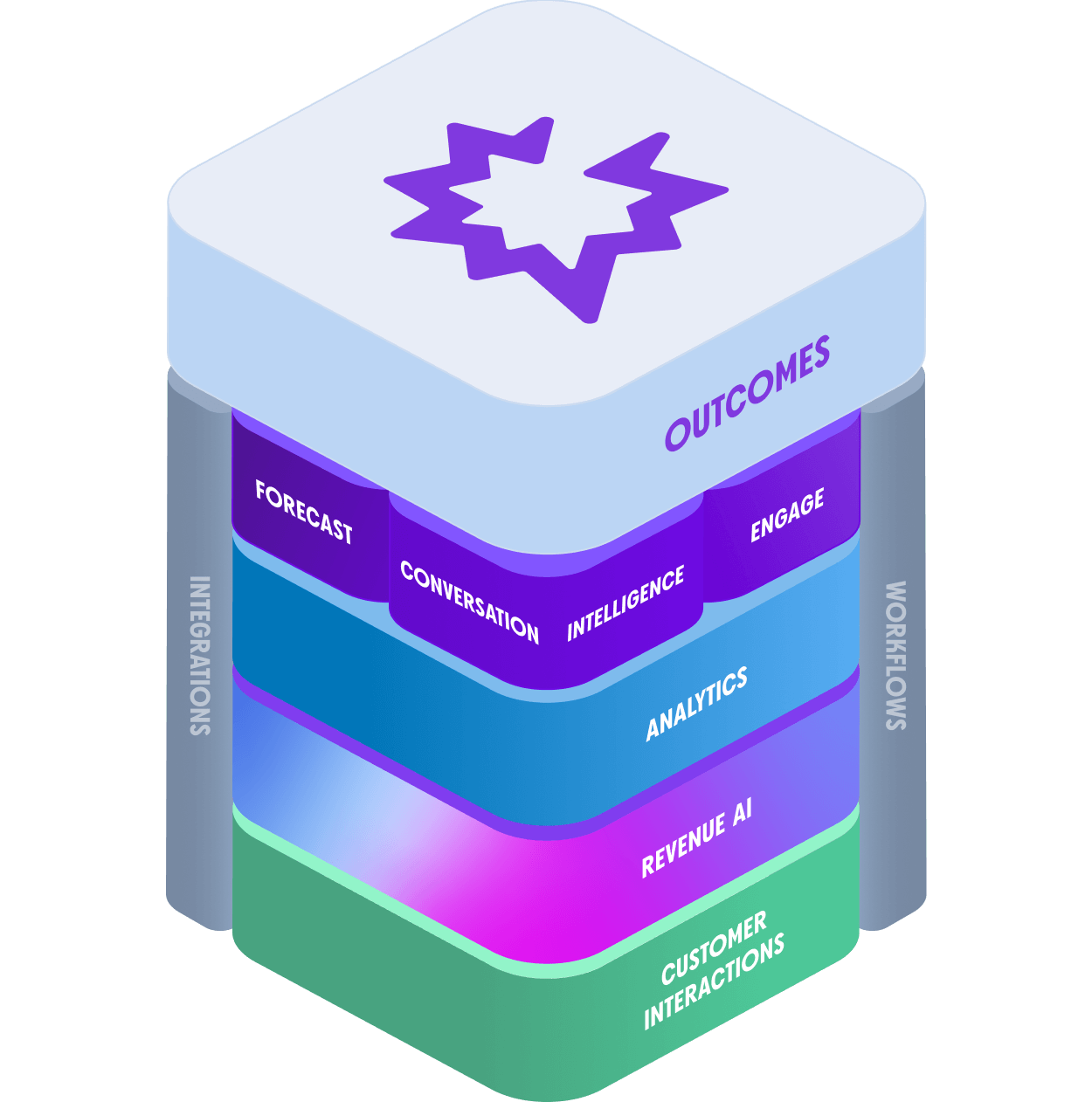

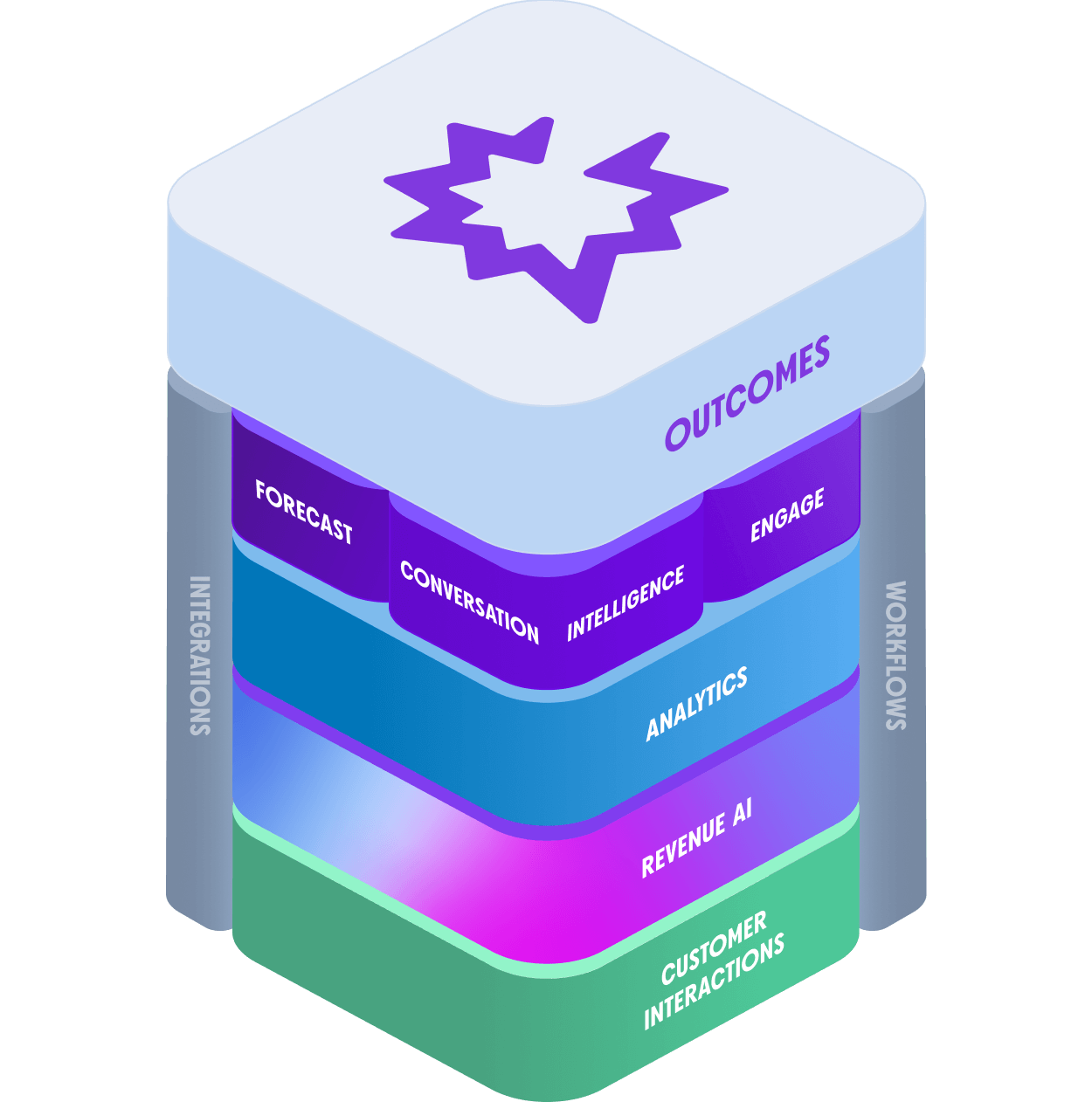

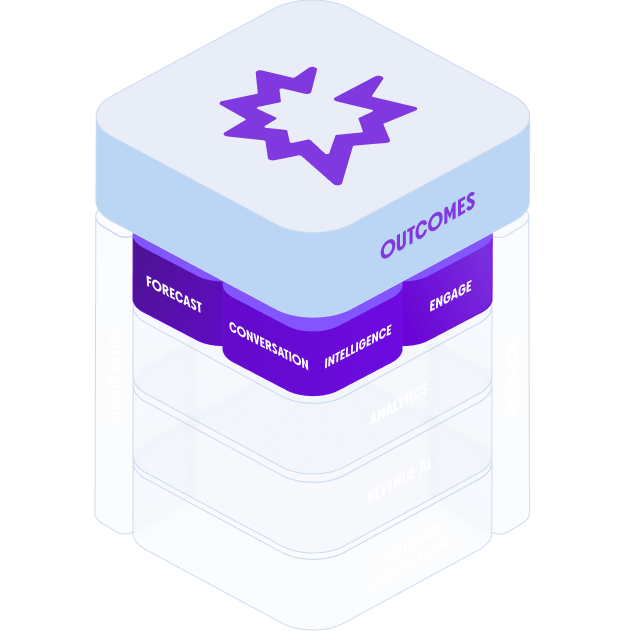

From Interactions to Insights to Revenue — All in One Platform

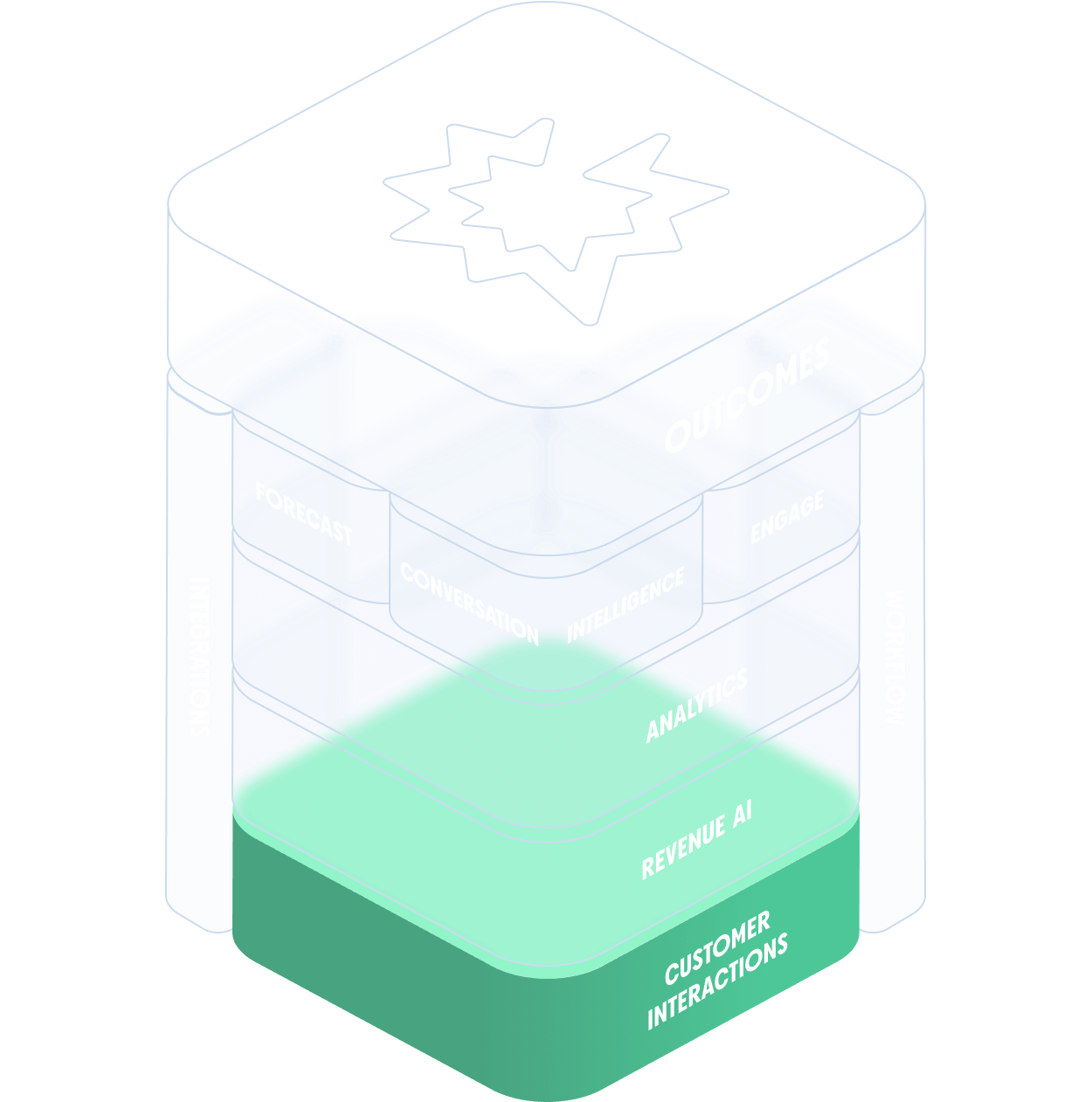

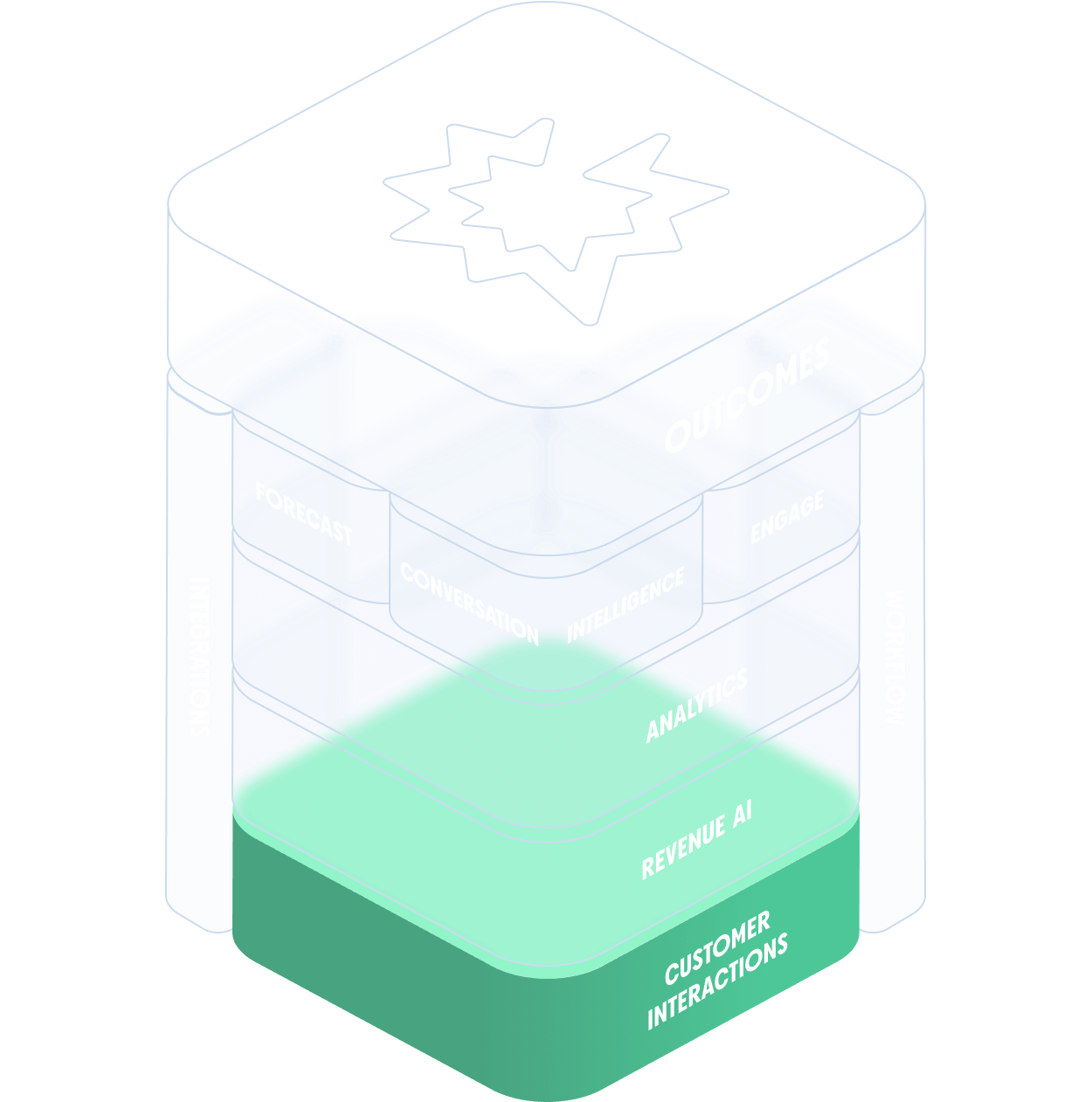

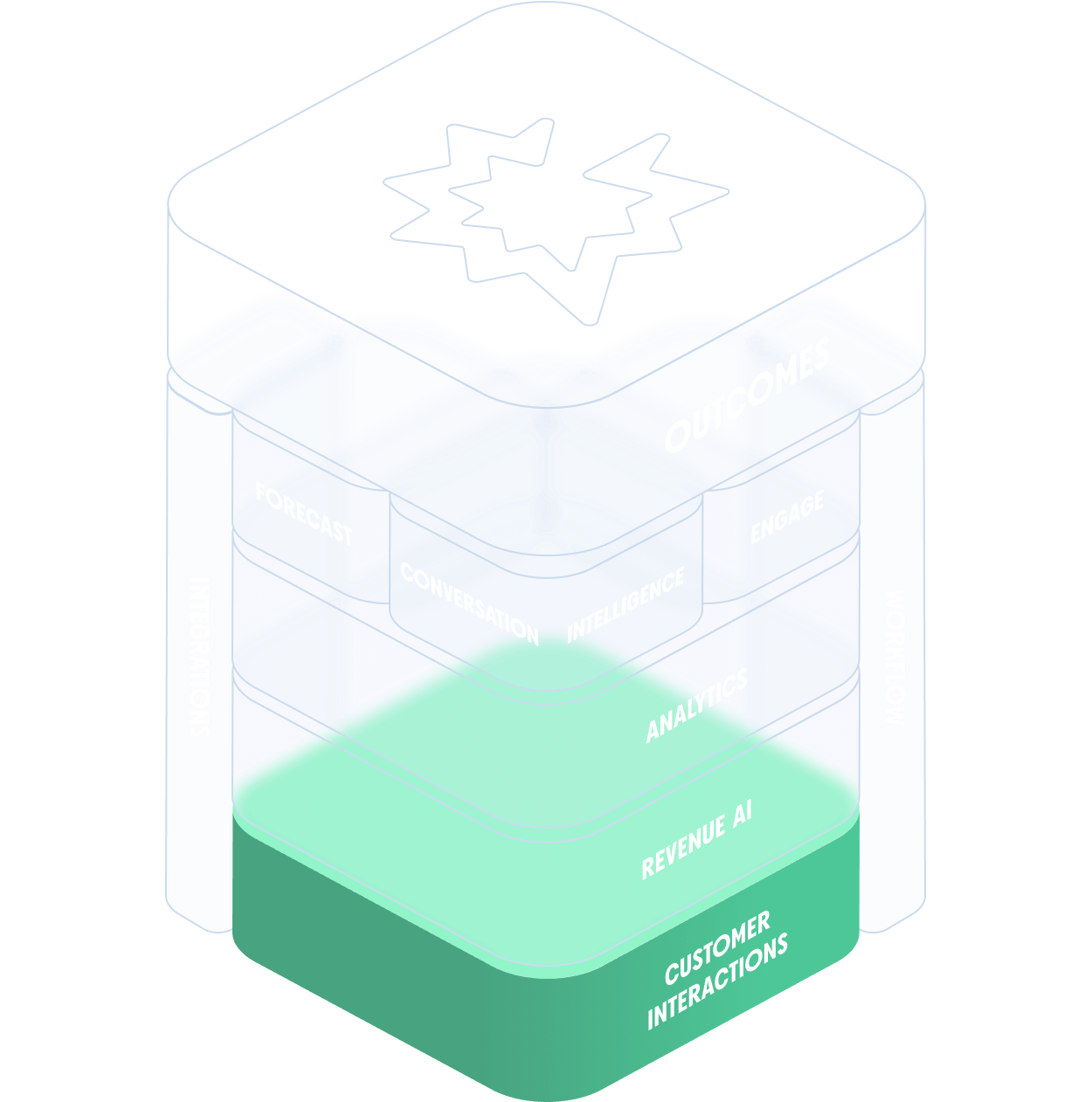

Built on customer interactions

Gong collects conversation data from everywhere you’re interacting with your customers – calls, web conferencing, text, website, and more – to give you a full understanding of the customer lifecycle.

See it in action

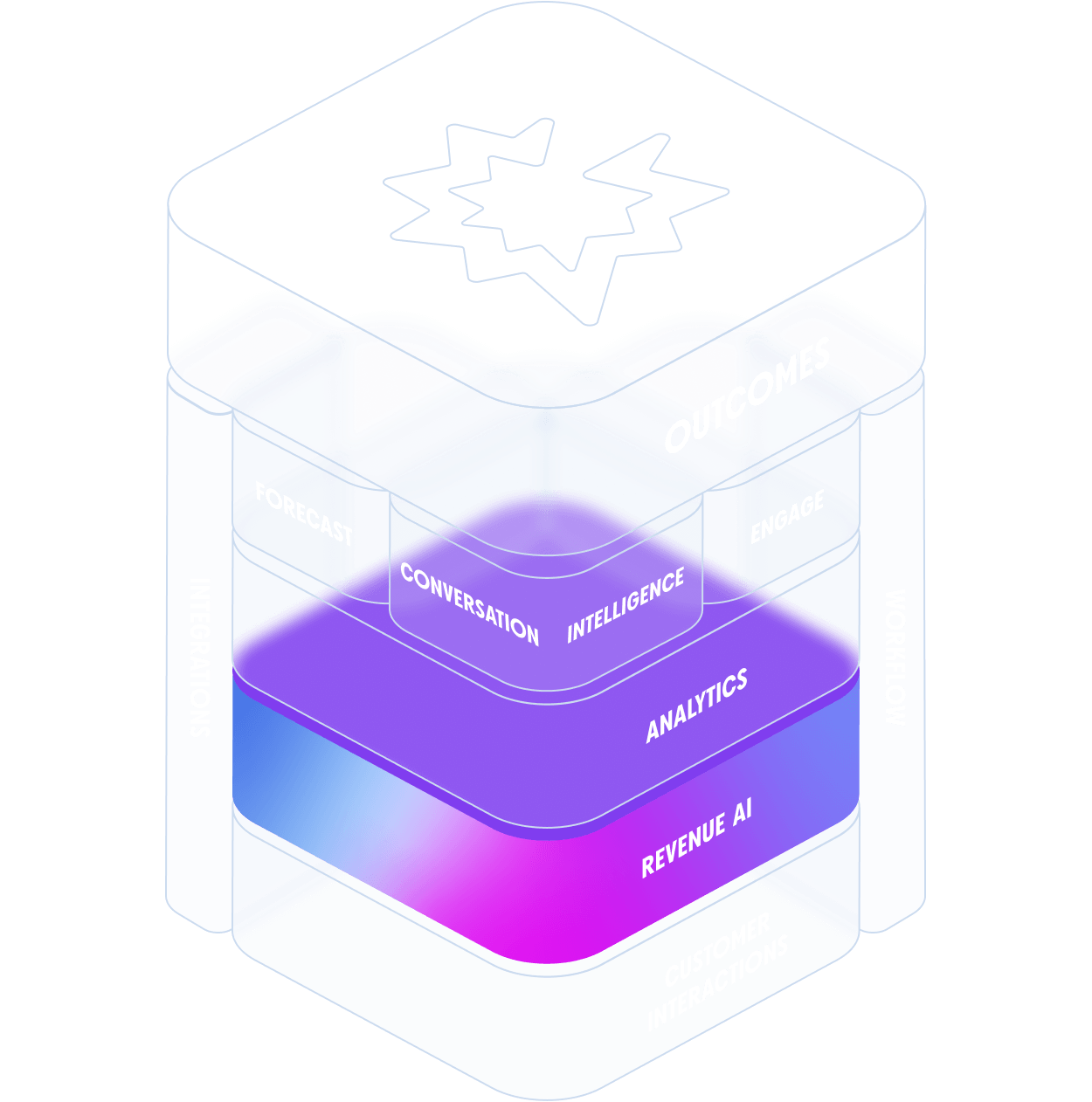

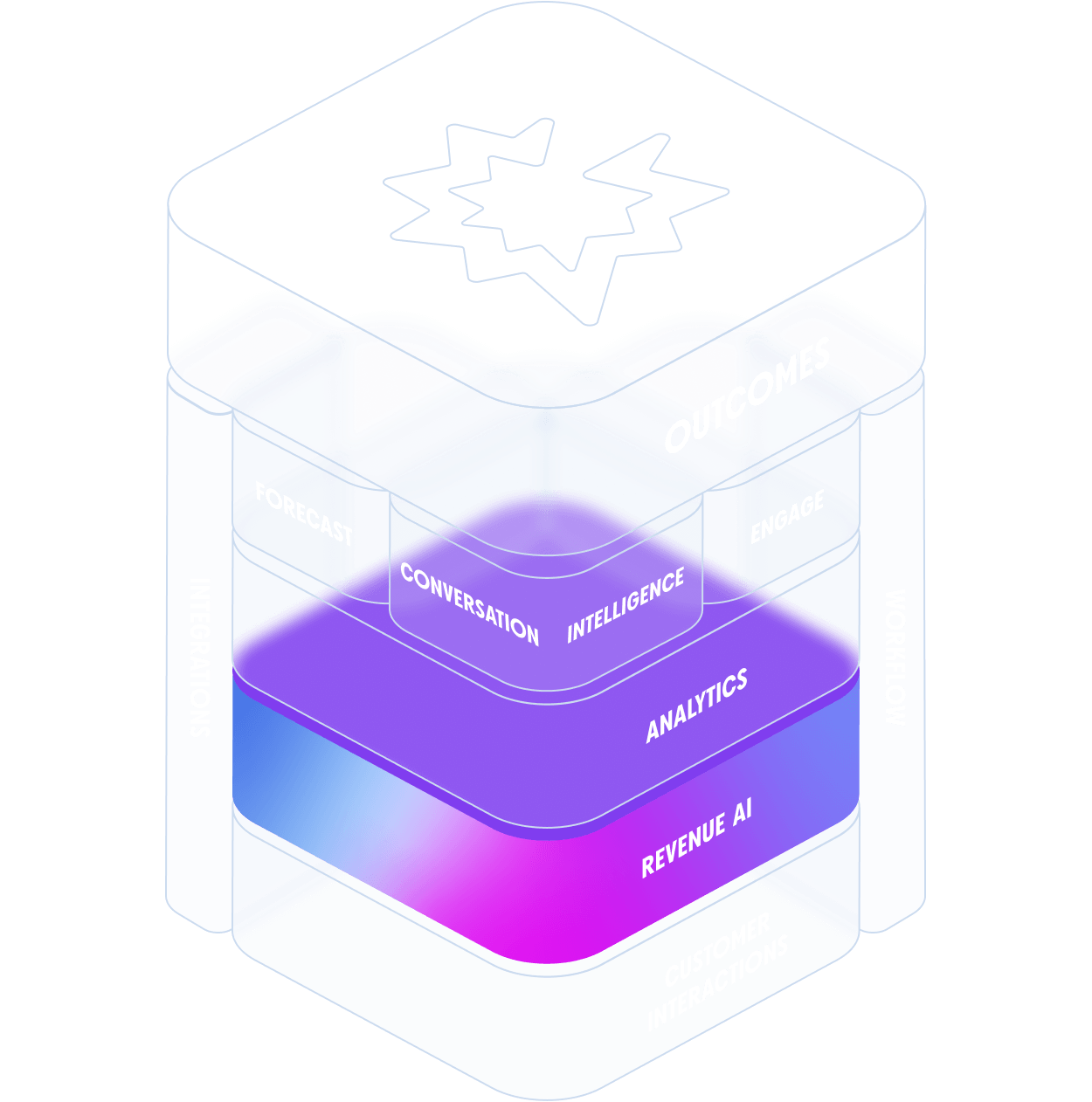

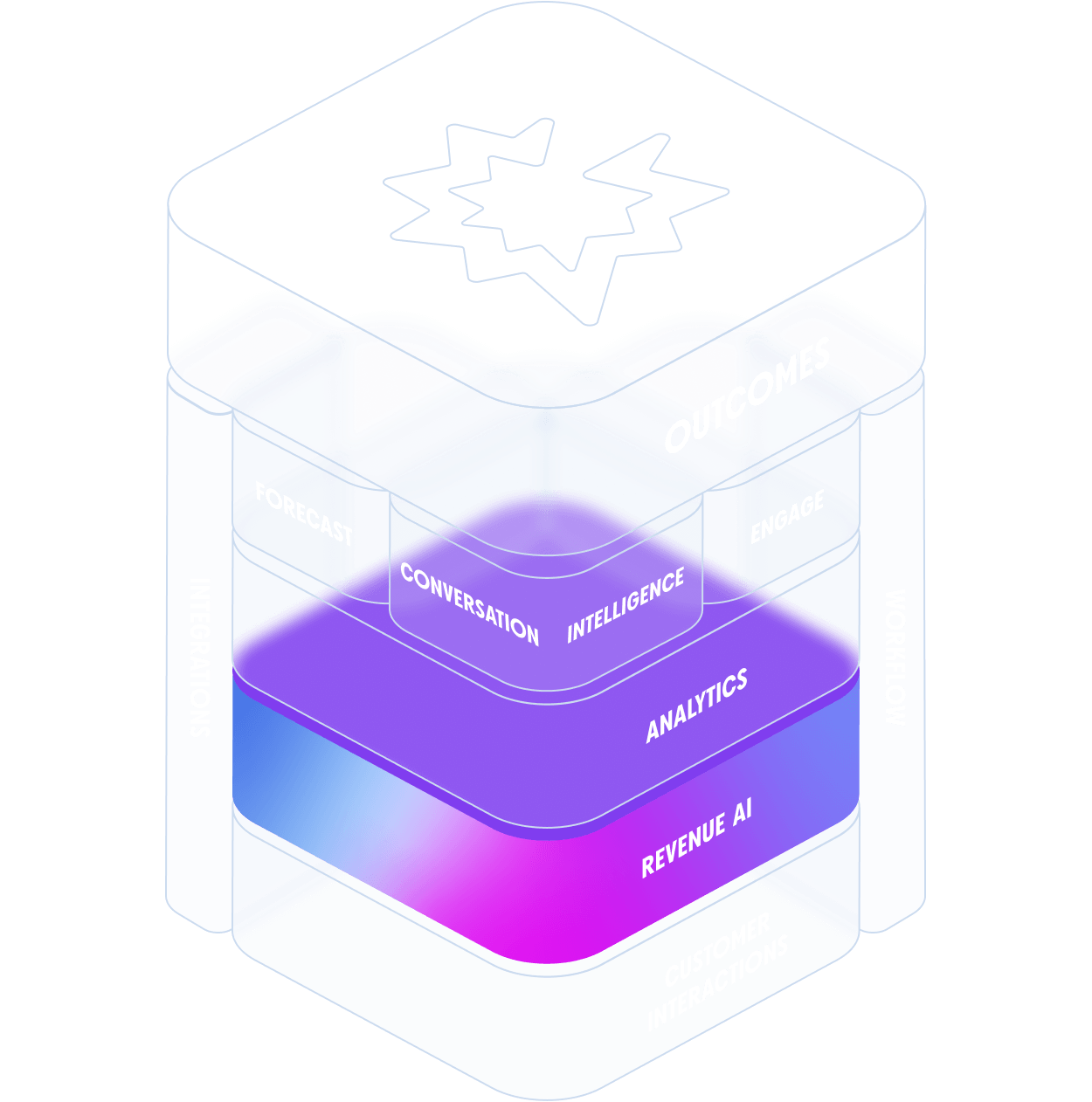

Powered by the industry’s leading AI

With 40+ purpose-built AI models, Gong accurately understands all of your customer interactions at scale without your team needing to lift a finger.

See it in action

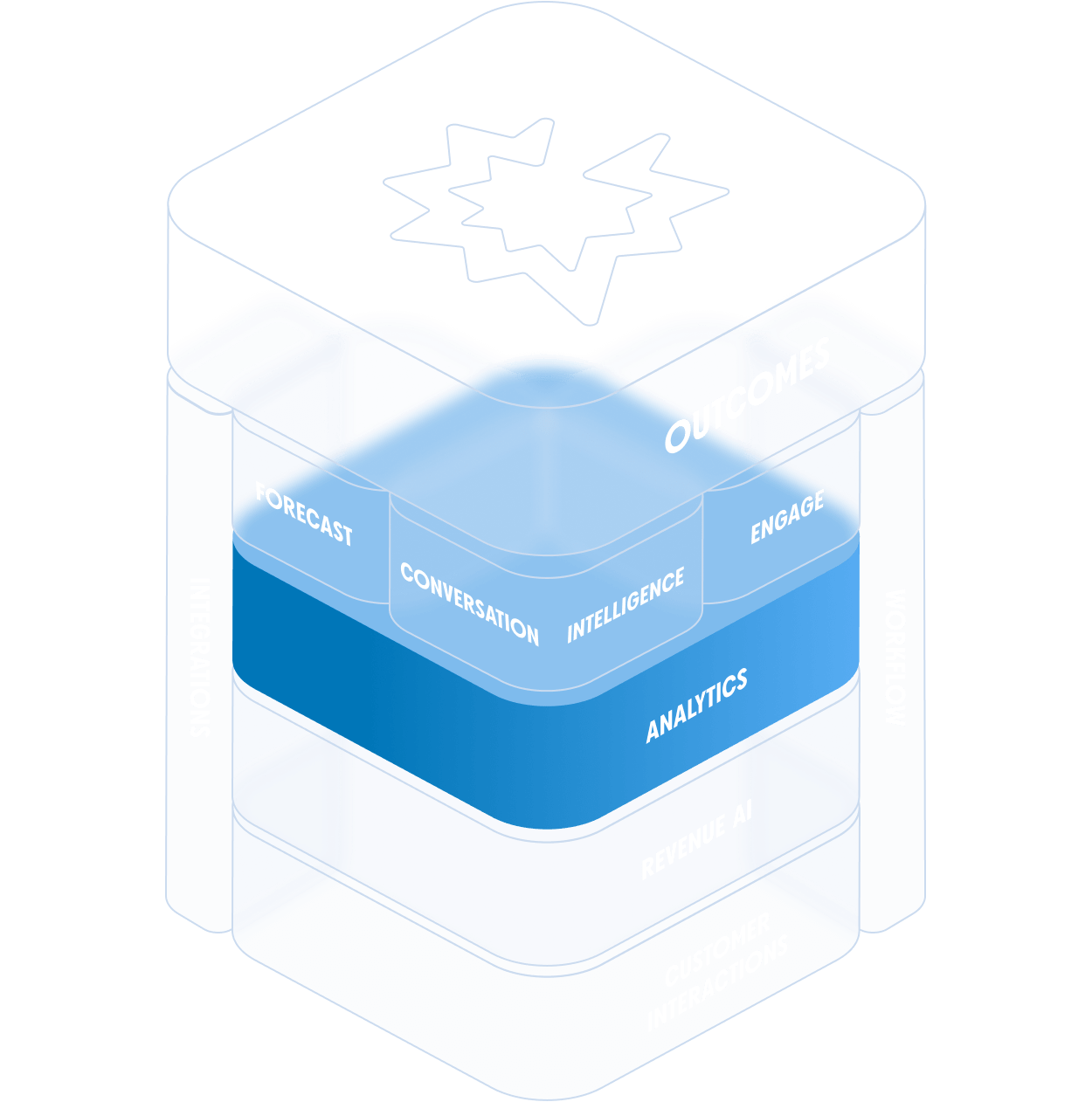

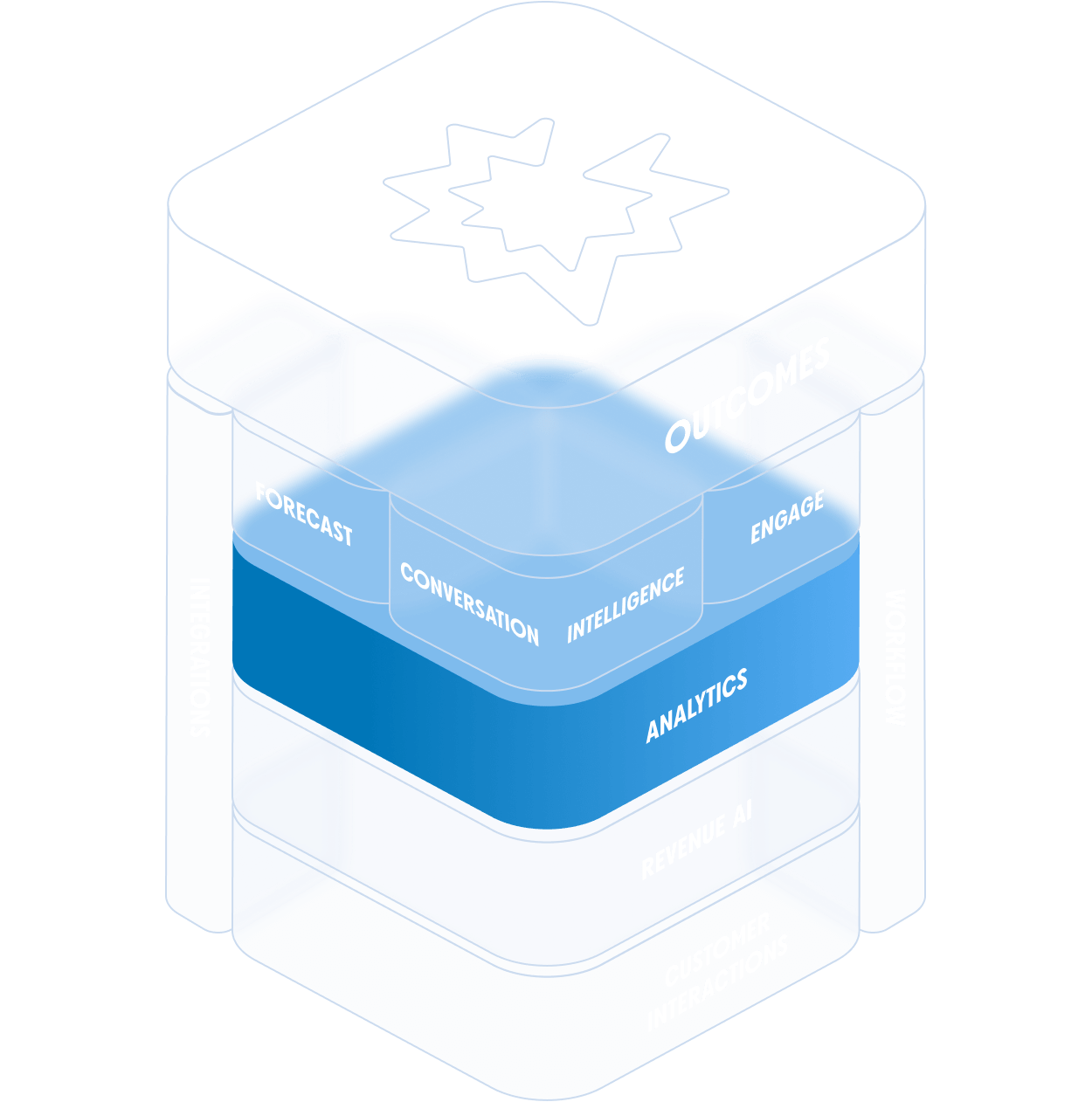

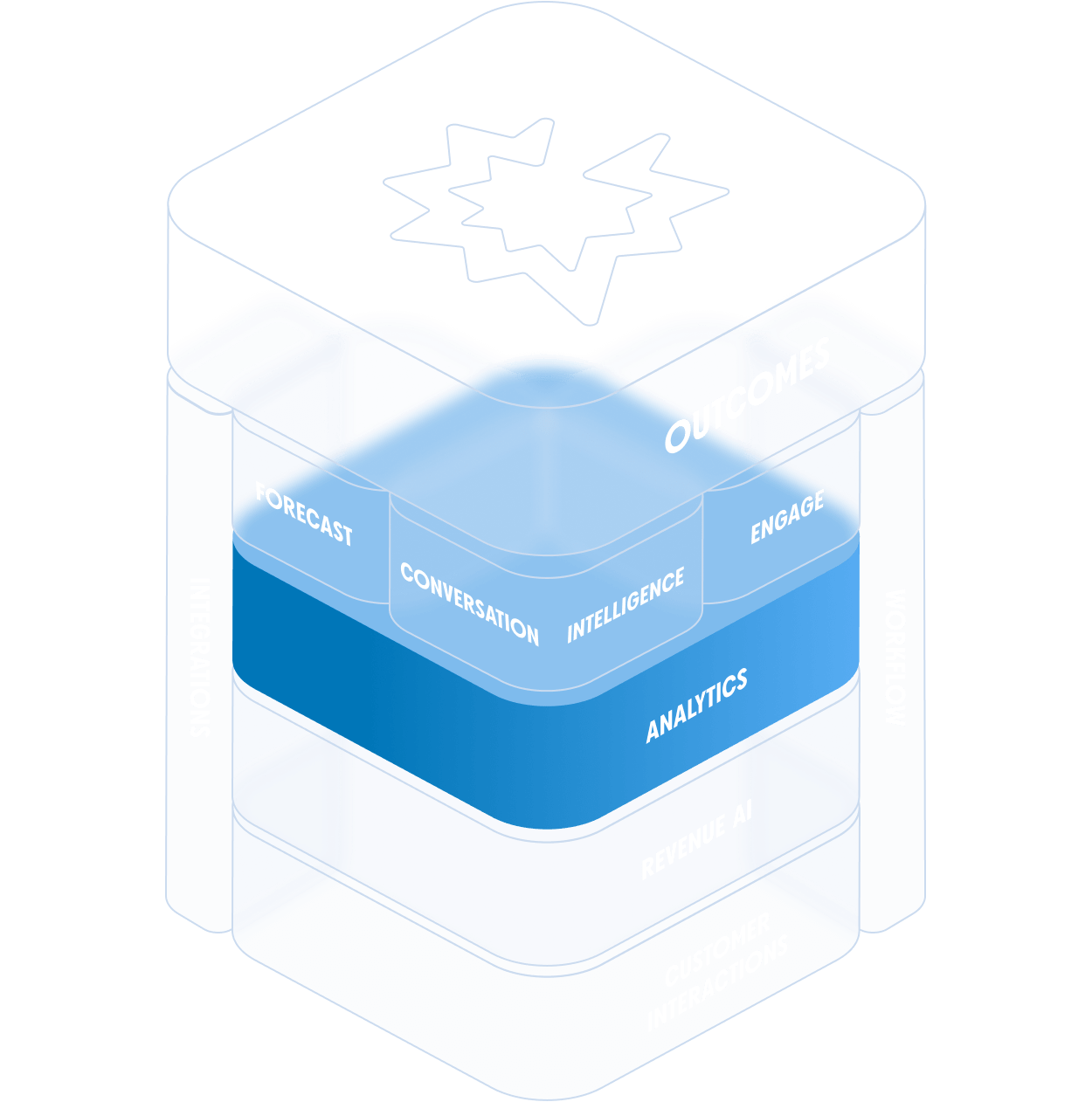

Meaningful insights to drive action

Quickly understand coaching opportunities, the voice of your customers, and pipeline performance in a matter of seconds, not just based on what your team says but the reality of what’s happening.

See it in action

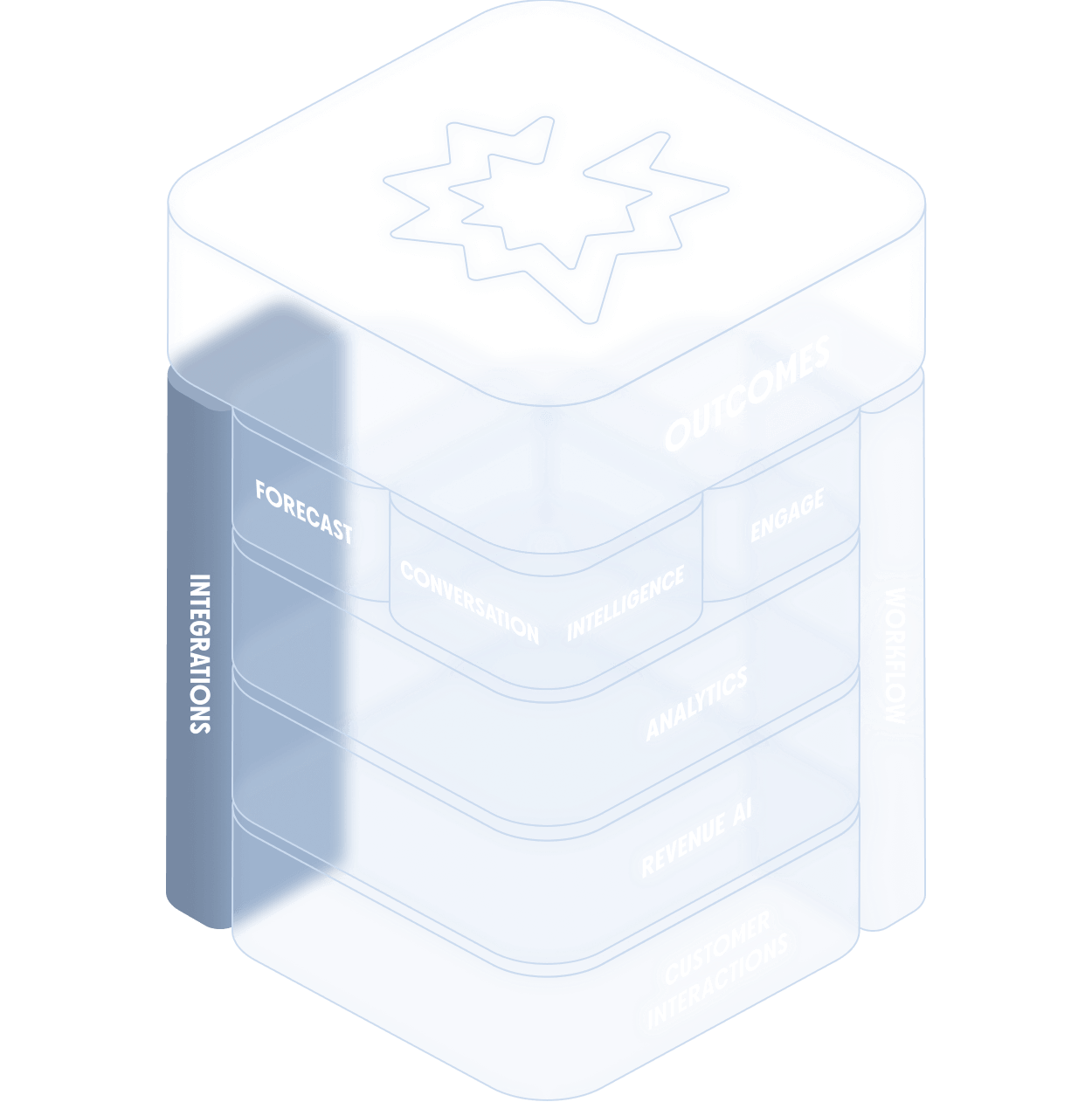

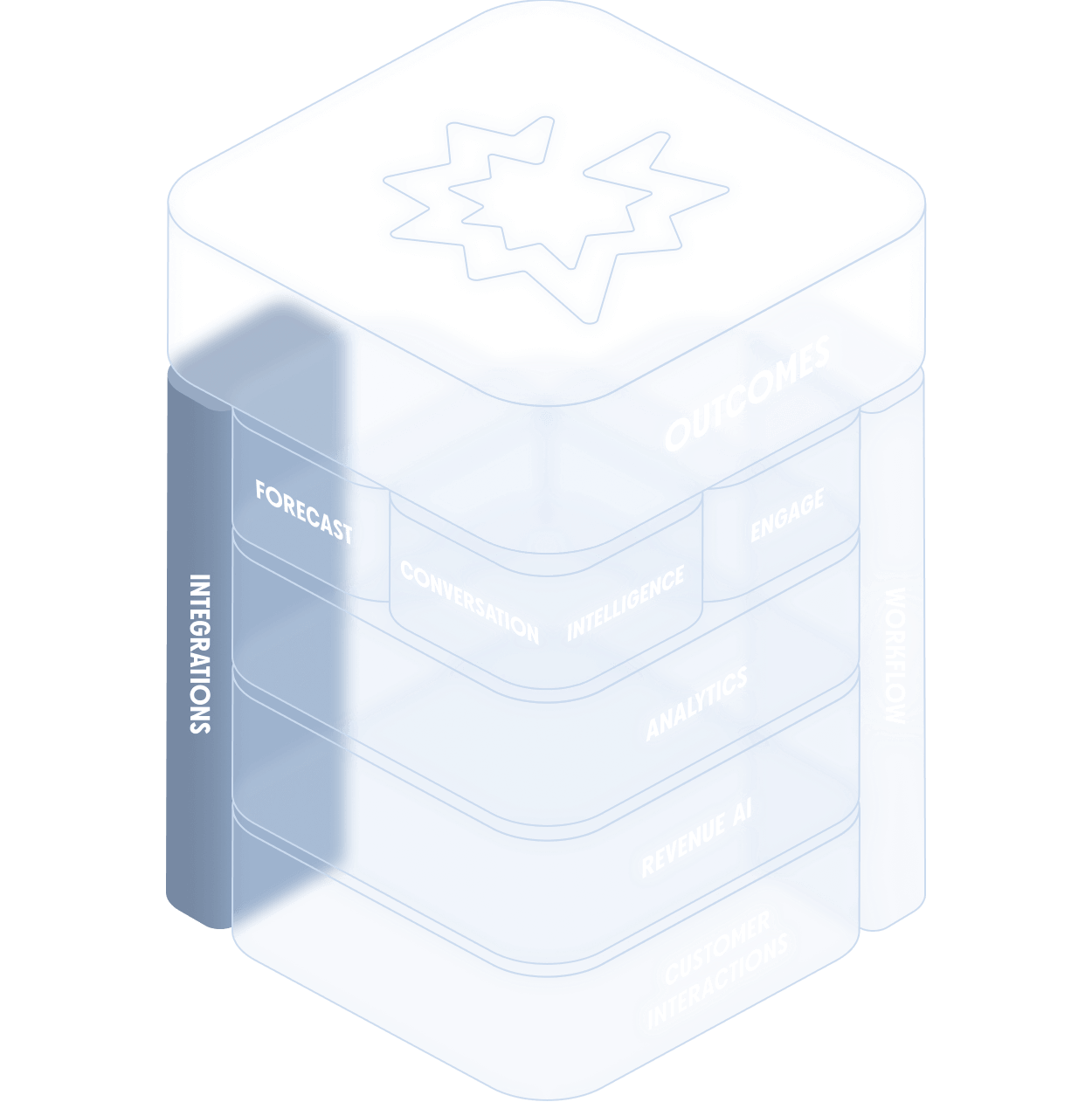

Enriched by a robust ecosystem

The Gong Collective is the industry’s deepest and broadest ecosystem, providing seamless integrations into your existing tech stack, enriching your CRM with powerful data, and giving you an unprecedented understanding of your business and customers.

See it in action

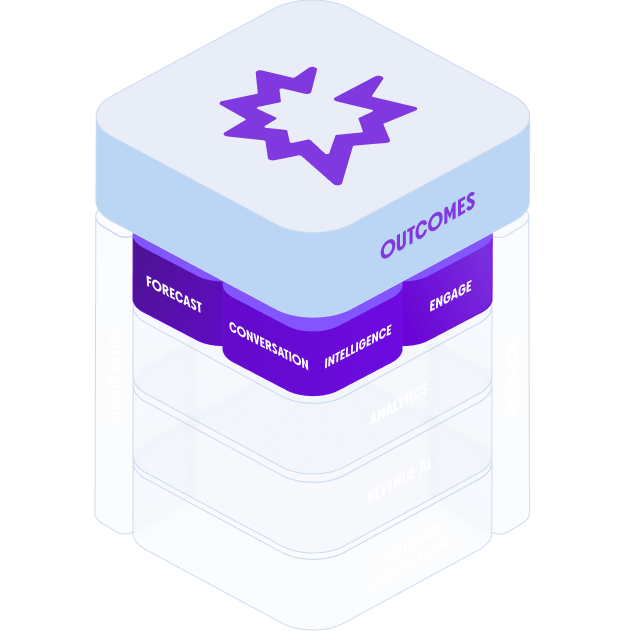

Purpose-built for revenue workflows and outcomes

From creating and managing pipeline to coaching your people, Gong powers your team’s most critical revenue workflows to drive business outcomes.

See it in action

Built on customer interactions

Gong collects conversation data from everywhere you’re interacting with your customers – calls, web conferencing, text, website, and more – to give you a full understanding of the customer lifecycle.

See it in action

Powered by the industry’s leading AI

With 40+ purpose-built AI models, Gong accurately understands all of your customer interactions at scale without your team needing to lift a finger.

See it in action

Meaningful insights to drive action

Quickly understand coaching opportunities, the voice of your customers, and pipeline performance in a matter of seconds, not just based on what your team says but the reality of what’s happening.

See it in action

Enriched by a robust ecosystem

The Gong Collective is the industry’s deepest and broadest ecosystem, providing seamless integrations into your existing tech stack, enriching your CRM with powerful data, and giving you an unprecedented understanding of your business and customers.

See it in action

Purpose-built for revenue workflows and outcomes

From creating and managing pipeline to coaching your people, Gong powers your team’s most critical revenue workflows to drive business outcomes.

See it in action

The Undisputed Leader in Revenue Intelligence