This article is part of the Gong Labs series, where we publish findings from our data research team. We analyze sales conversations and deals using the Gong Revenue Intelligence Platform’s proprietary AI, then share the results to help you win more deals.

You’d best believe that 2023-24 has marked a challenging time for sales reps.

In a recent Gong study of more than 100 CROs and VPs of Sales, 81% of them said their team’s deals are significantly more complex than they were in 2022.

Open opportunities are taking longer to close, average deal sizes are shrinking, and new business wins are harder to come by.

Each of these trends had a compounding effect on sales velocity last year, making it increasingly difficult for organizations to call and hit their targets.

Despite it all, 68% of revenue leaders are still optimistic that sales performance will improve this year.

To make that possible, we dove into data to uncover what reps are up against.

About our analysis

To better understand what exactly makes deals more complex for sellers today, we examined three factors that have influenced sales opportunities in recent years. The analysis included more than 24M sales calls from 2022 to 2024.

Gong’s Smart Trackers identify, track, and alert revenue teams when specific concepts are mentioned in customer conversations. This goes well beyond keywords, by identifying any combination of words a person might use to discuss these topics of interest. We used these Smart Trackers in our analysis to quantify how prevalent these issues are.

Throughout this article, we’ll use mentions per call to showcase how deals are growing in complexity. This metric tells us how each topic is trending across the millions of sales calls we analyzed. For example, if an organization had 100 sales calls and the given Smart Tracker topic was mentioned 50 times, its “mentions per call” would be 0.5.

Macroeconomic pressure is undeniable

In August of 2022, we published an analysis of how the economic downturn was beginning to impact sales opportunities. It turned out our results were an early sign of things to come. In the 20 months since, we’ve seen layoffs, shrinking budgets, and lackluster sales performance.

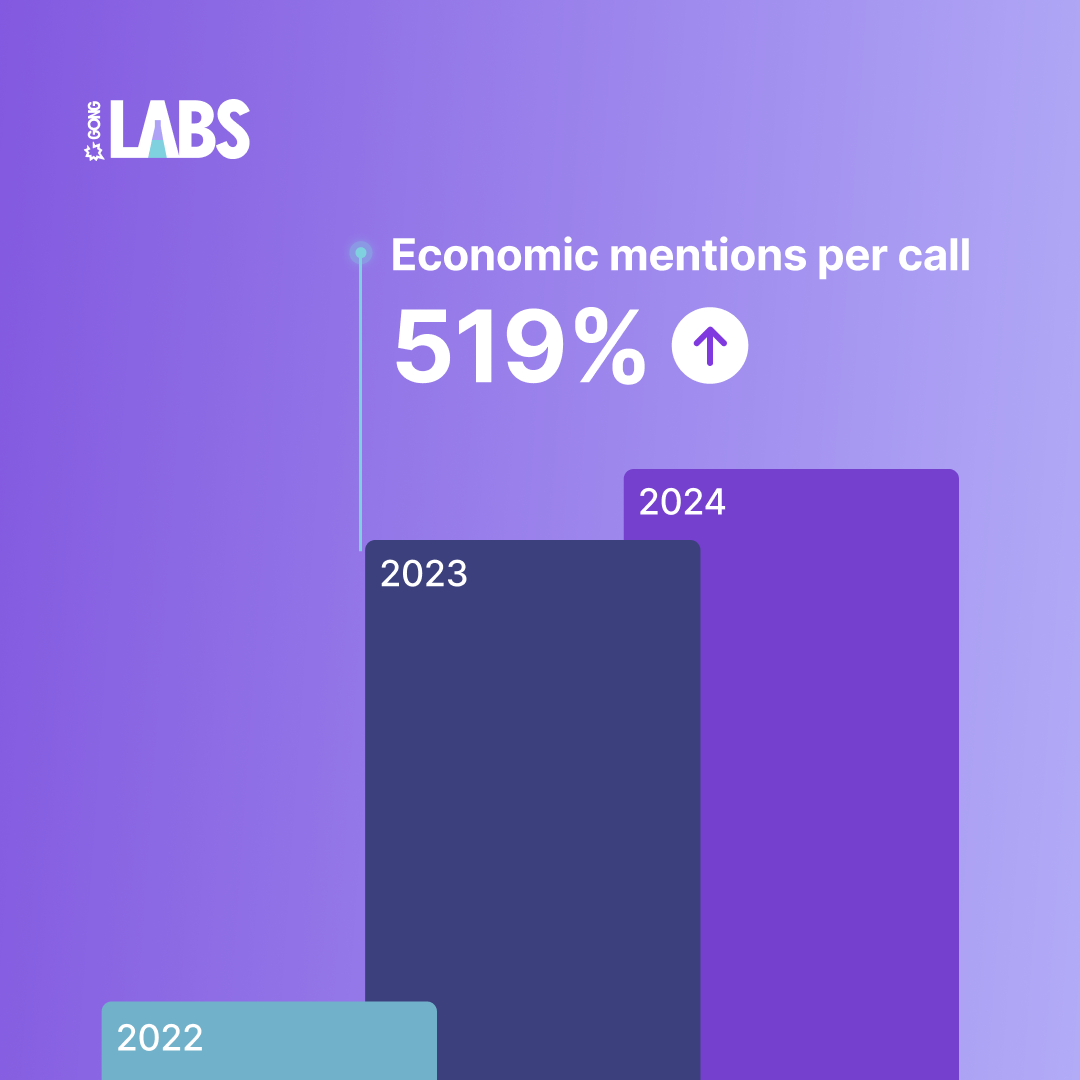

By 2023, there was a 519% increase in the average number of economic mentions per call.

Hearing directly from your customers on how market factors impact their organization is critical to adapting your deal strategy and keeping it up to date. It’s also essential to making your revenue process more predictable. While you might not feel the immediate influence of what you’re hearing, it will still help you understand the potential impact on your future forecasts. You can also correlate what you hear to other economic indicators.

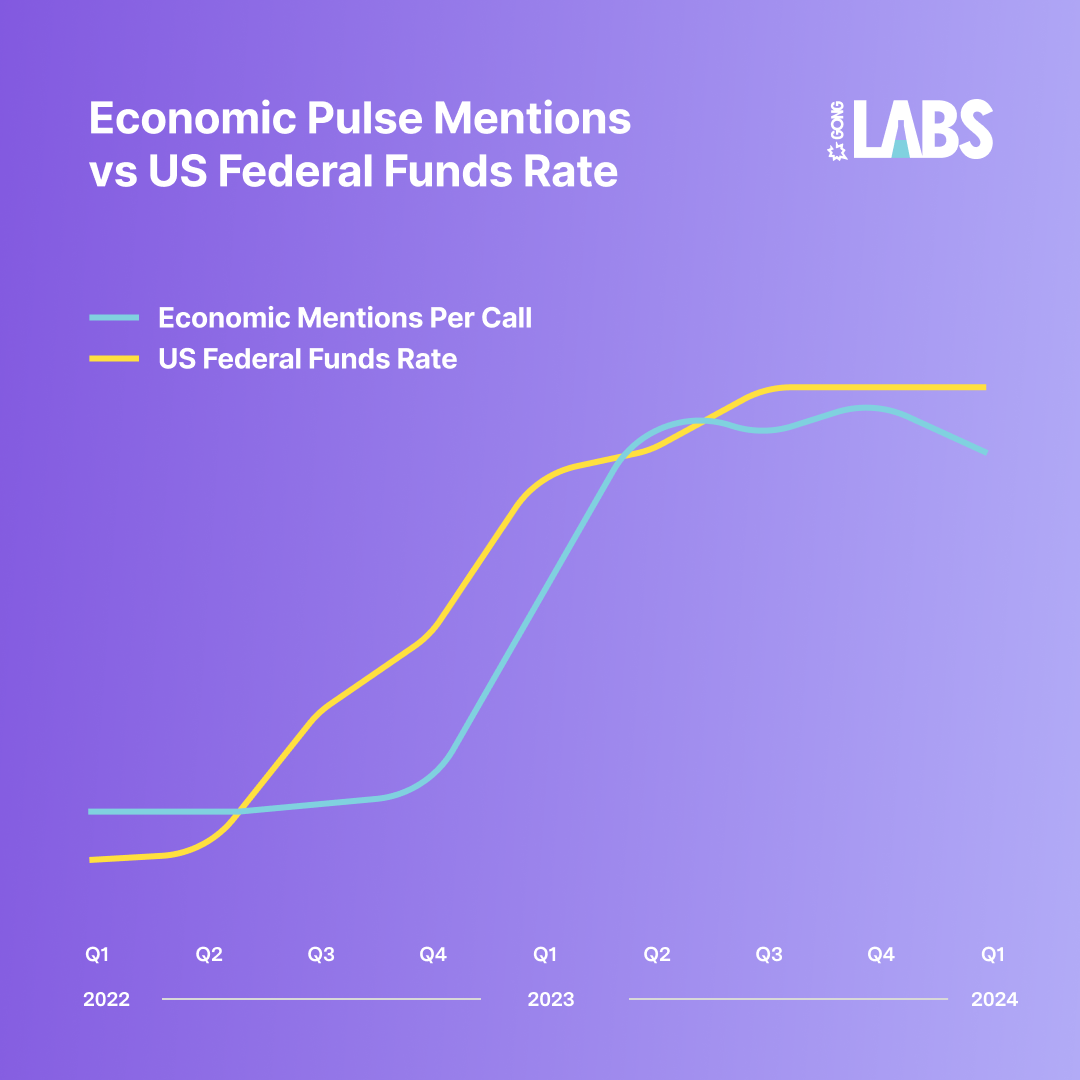

In the example below, we included the US Federal Funds Rate and a quarterly average of economic mentions in sales calls. Interest rates began to rise in Q2 of 2022, but deals were not heavily impacted until roughly two quarters later.

The good news here is that as the fed rate stabilized at the end of 2023, economic pulse mentions began to decrease. Here’s hoping that clearer skies are ahead.

Ultimately, by understanding this relationship in your own book of business, you can not only improve forecast accuracy, but prepare and enable your sellers to proactively address concerns before they negatively impact performance.

Price sensitivity needs your attention

As rising interest rates and external market factors began to affect budgets in 2022, decision makers became increasingly sensitive to price. At the beginning of 2023, we found that the average length of pricing conversations had increased by 62% since 2020, signaling that sellers needed to adapt their negotiation strategies.

That emphasis on pricing continued throughout 2023, with an 18% increase in the number of pricing mentions since 2022.

In direct response to these tightening purse strings, sellers tended to offer more discounts. Makes sense right?

Only sometimes.

That’s why it’s a trend leaders should keep a close eye on this year.

While discounts undoubtedly help sellers close deals, they often extend deal duration and can sometimes signal that the customer is not an ideal fit.

Instead of leading with a discount, reps should uplevel their negotiation tactics. (If you need help with this, read our 10 golden rules to master any pricing conversation. It’s based on Gong Labs data from 519,000 calls.)

Leadership should also reinforce negotiation strategies that are best for the business. For example, incentivizing sellers to close multi-year contracts can lower costs, reduce churn, and even block out competitors. (We’ll get to the competition in a second…)

No matter your company’s take on discounts, make sure that your pricing strategy is up to date and aligned with the value your customers expect in current market conditions.

Increased competition is manageable

As price-sensitive buyers search for more value, deals in 2024 are more competitive than ever. Since 2022, the average number of competitive mentions has increased by 57%.

While your solution might have been the obvious choice in years past, buyers may now be settling for a less expensive option that meets most of their needs.

The good news is that the timing of when competitors are mentioned plays a large role in how they shape deals. Understanding this relationship informs how a seller should approach these conversations.

When competitors are discussed early in the sales cycle, it’s a positive signal that the buyer has real intent to buy. They know other players in the space, and are most likely educated about your offering and the problem it solves. In fact, an early competitive mention increases the odds of winning an enterprise deal by 32% over not discussing the competition.

This is the time for a rep to set their offering apart from the rest and work with their champion to build a watertight business case.

On the flip side, if competitor mentions happen in the late stages of a sales cycle (e.g., during negotiations), the deal is under threat, and the odds of closing the deal decrease.

If competitor discussions are still happening at this point in the deal, the rep needs to uncover the source of the buyer’s uncertainty. Is it something the rep can control for? Or is it purely leverage to drive down your price?

With complete visibility into the context of these competitive scenarios, sellers can improve their win rates while avoiding a “race to the bottom.”

It’s time to adapt (and simplify)

Who’s going to succeed in turning optimism into reality this year? Teams that prioritize simplicity over complexity.

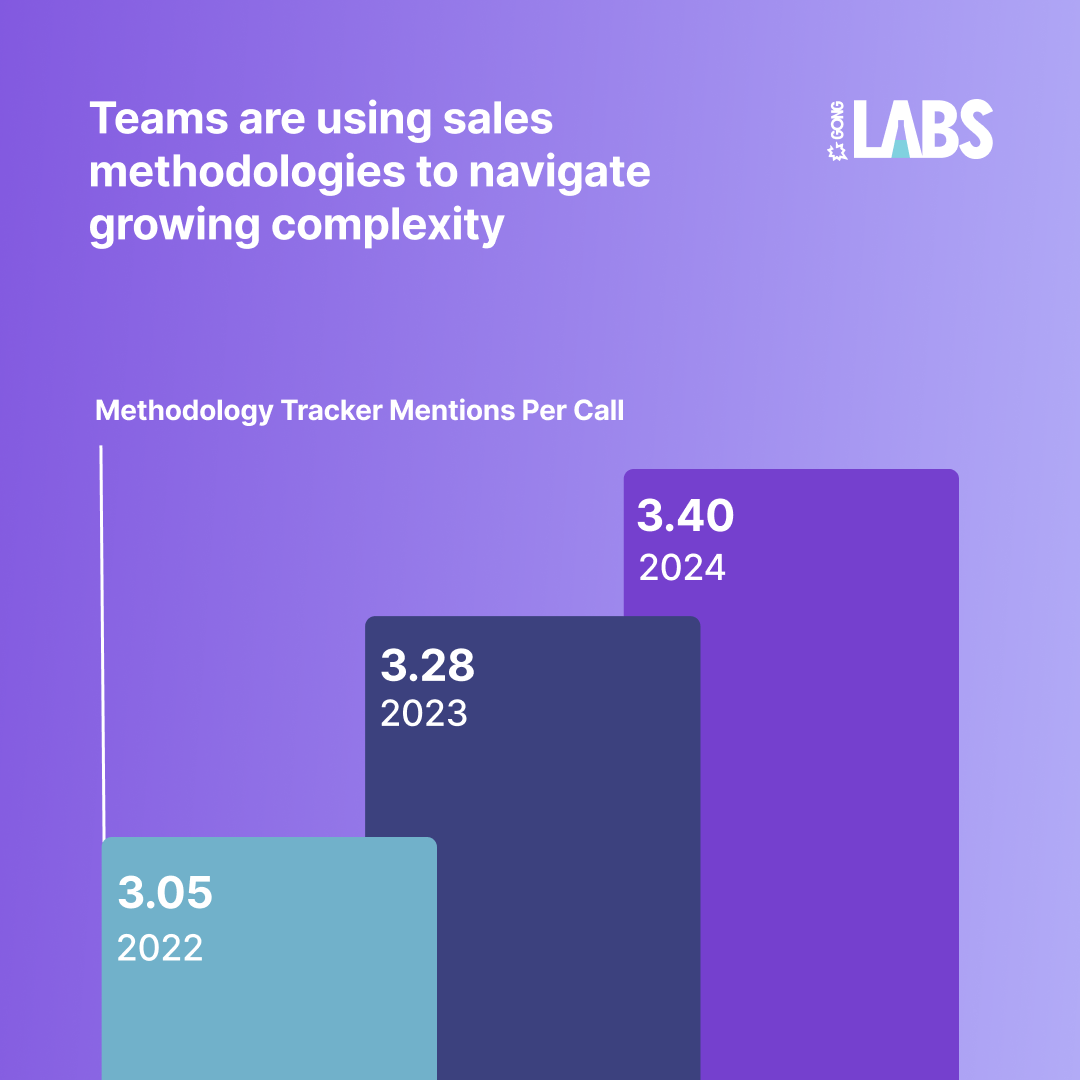

Given that, we hypothesized that some sellers would take a deeper look at their sales methodologies. These methodologies give sellers a formal framework for each phase of their opportunities. Whether you use an established framework on your team or create your own, a methodology breaks complex sales cycles into more manageable phases for your sellers.

To test our hypothesis that sales organizations want to add structure to their deals, we created a Smart Tracker to identify some of the industry’s most popular sales methodologies (e.g., MEDDIC, N.E.A.T., Challenger, Sandler, Solution Selling, etc.).

Though there’s not as much disparity in this data as there is in some of the other data in this article, there is indeed an increase in methodology adoption across the thousands of organizations using Gong.

The success of a sales methodology has less to do with which framework is chosen and more to do with how it’s adopted and applied. Importantly, because they’re using a revenue intelligence platform, these teams have complete visibility into which reps use the chosen sales methodology. They also know how reps apply it to each opportunity and the methodology’s impact on success metrics like win rate and deal duration.

Despite the fact that selling is more complex than ever, revenue organizations can still adapt and outperform previous years. Whether you need to streamline your technology, create repeatable sales processes, or uplevel your selling skills, aim to simplify what’s within your control this year. It’s the surest way to reach your goals.