Spot these four red flags to enhance forecast accuracy and revenue predictability

This article is part of the Gong Labs series, where we publish findings from our data research team. We analyze sales conversations and deals using the Gong Revenue Intelligence Platform’s proprietary AI, then share the results to help you win more deals. Subscribe here to read upcoming research.

How did this happen again?!

The end of the quarter hit and you missed your forecast by a large margin.

You did everything right. Established clear forecast criteria. Conducted regular pipeline inspections. Ran deal reviews using CRM data. Monitored pipeline pacing every week.

And you still missed.

What gives?

The problem is that despite your efforts, you’re missing an enormous piece of the puzzle.

(In fact, you’re missing about 300 pieces of the puzzle. But we’ll get to that.)

You can’t afford to have an inaccurate view of your pipeline when so many business decisions depend on you getting it right. A missed forecast can also be dire for public companies… or the tenure of revenue leaders in any industry.

It’s critical that you get a more accurate picture of your pipeline.

CRM data is a poor foundation for forecast accuracy

The Gong Labs team recently analyzed over 1M emails and nearly 30,000 sales calls from 2022-23 to understand which data points are effective, trustworthy predictors that a deal will close in a given timeframe.

The results confirm that CRM and deal activity data alone aren’t enough to help sales leaders create accurate forecasts.

CRM data relies on reps’ manual data entry, so it’s often incomplete, inaccurate, and subjective. (Only 1% of customer interactions make it into the CRM, according to Gartner.) Reps record the data they believe is important, but it’s not always a full picture of the account. Plus, reps often interpret CRM fields differently, so subjective answers about what’s likely to close, for example, get rolled up into larger forecasts.

You can’t call an accurate forecast if it’s founded on unreliable data.

How to spot red flags that prevent deals from slipping

Why is everyone getting their forecast so wrong? Because they can’t spot the red flags in their deals’ contextual data.

(In Gong, “red flag” alerts are triggered when a buyer or seller’s emails indicate a risk to the deal. That might include signs of ghosting, or a buyer making subtle mention of budgetary constraints or a decision-maker’s lagging interest in a purchase.)

The result: Everyone settles for hoping that committed deals will close.

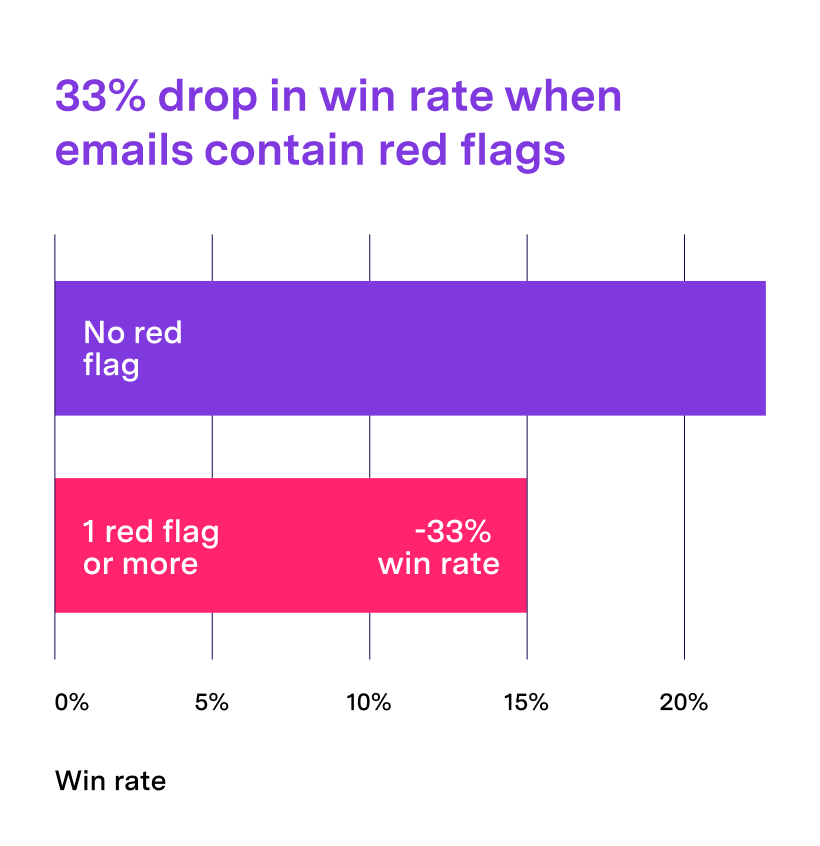

How widespread are foreseeable problems in your deals? Approximately 15% of the opportunities we analyzed had a red flag hiding in their email exchanges.

Those red flags have the potential to rock your forecast.

When one or more red flags exist in a deal’s emails, you have a 33% lower probability of winning the deal:

When you spot a red flag, you need to dig deeper to understand if it was caused by something fixable. Then you can decide whether the deal is worth including in your forecast.

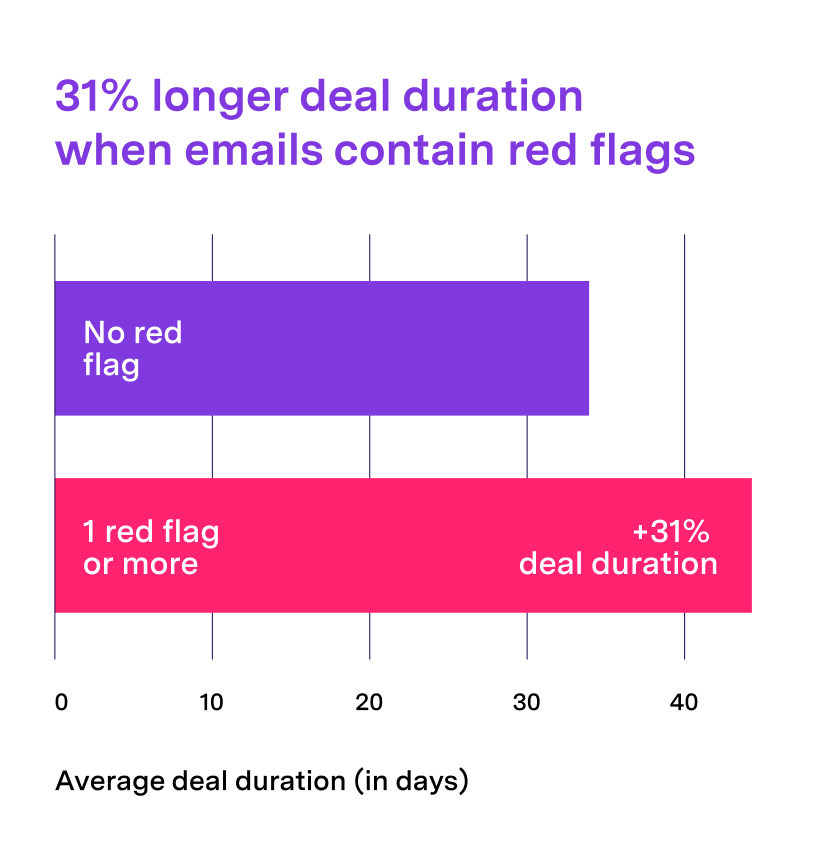

Either way, a deal containing a red flag will likely push out from its original commit date. Deals with red flags take 31% longer to close, on average:

Address 4 key deal risks to drive revenue predictability

There are hundreds of unique deal signals inside and outside your CRM that you can analyze to detect threats inside deals. We uncovered those signals and what you can do about them.

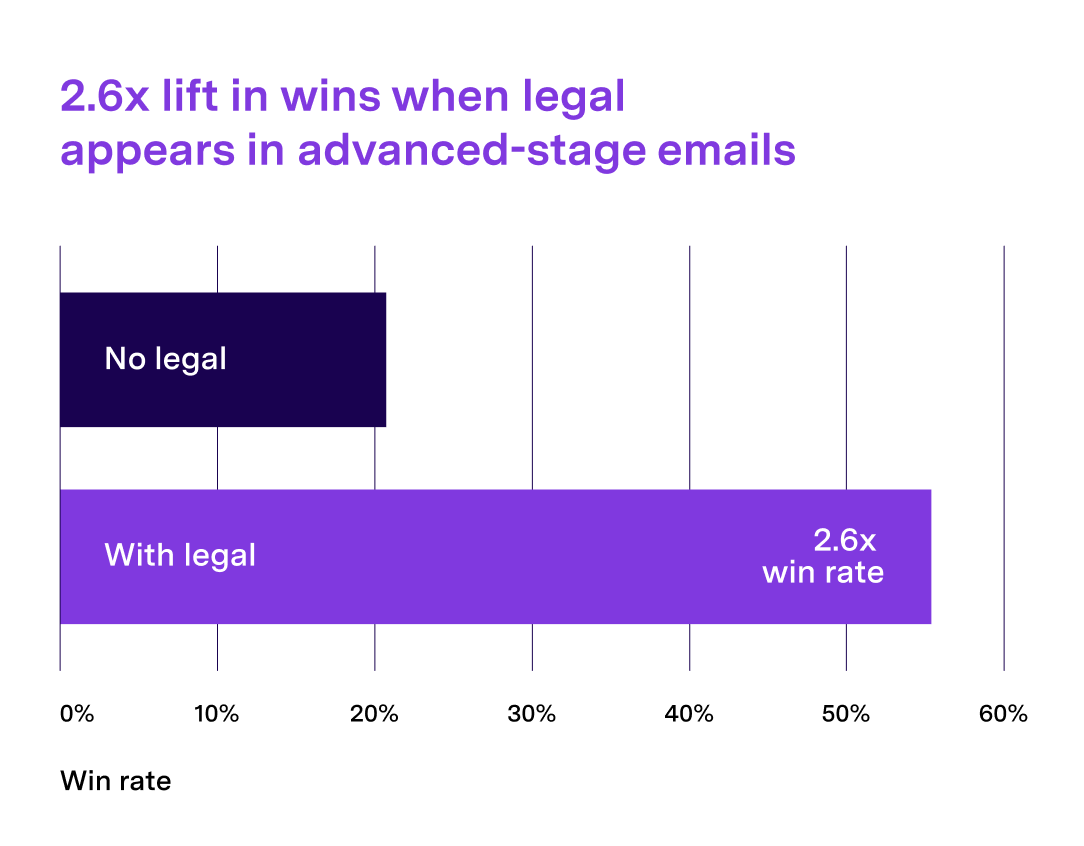

1. When legal is involved, there’s a 2.6x lift in wins

Reps often leave their buyer’s legal department out in the cold for fear that lawyers will slow the sales cycle or scuttle the deal altogether.

But we found that when legal is involved in the advanced stages of a deal, the win rate is 2.6x higher than when they’re not involved:

What does this mean for your forecast?

If you’re considering a late-stage deal in your forecast, double click into its data to validate that it’s truly a committed deal.

If legal isn’t involved yet, the buyer may not be as serious as you think… especially if your organization focuses on enterprise deals, where legal is almost certainly involved before anyone signs.

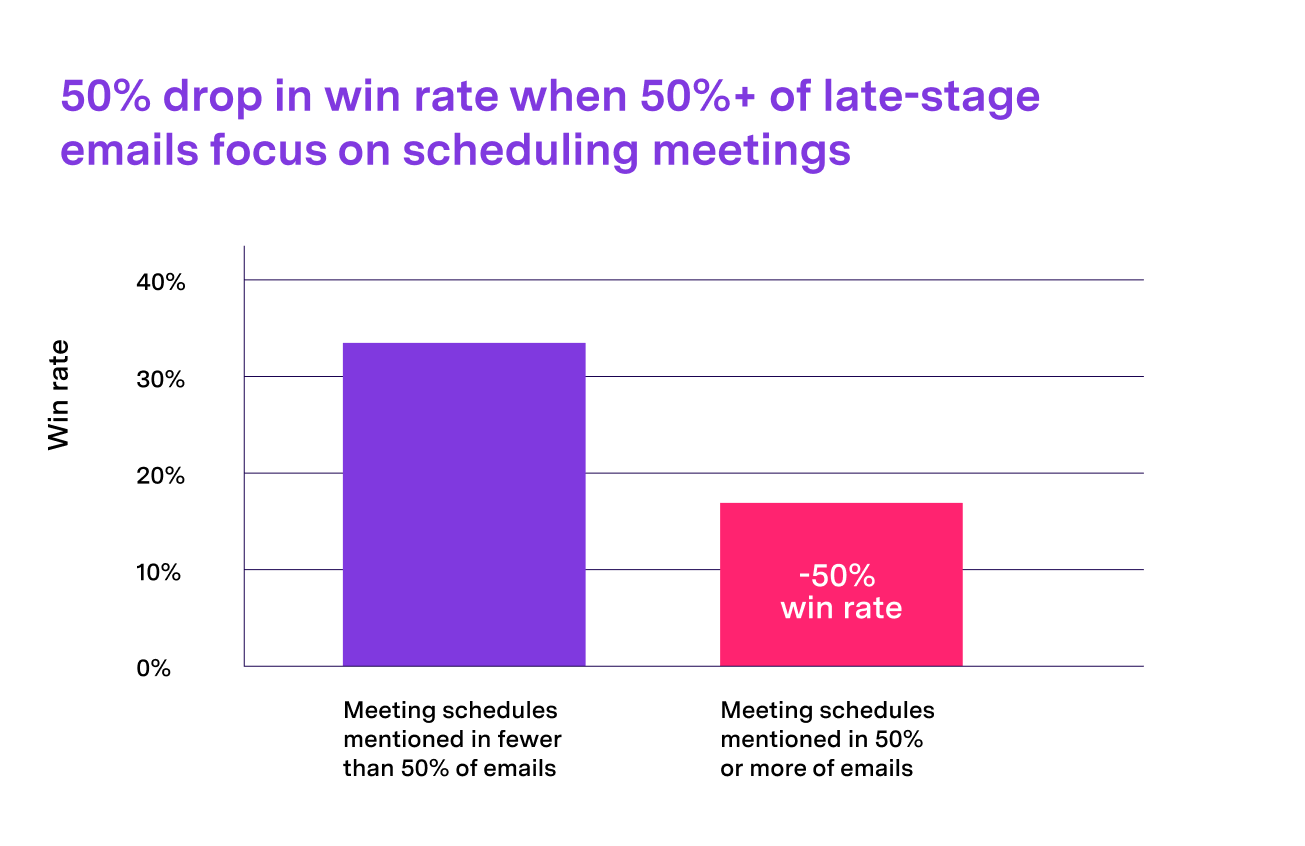

2. Don’t let ‘scheduling meetings’ undermine your email velocity stats

You see that your reps’ email velocity is high across your pipeline and it looks like buyers are engaged. That’s great!

… Or is it? The content in those emails matters as much as their velocity.

If reps and buyers exchange too many emails about scheduling, for example, especially late in a deal, it’s bad news. If it takes a ton of effort to get a meeting on the books, that might indicate a buyer’s dwindling interest in the deal.

According to our data, if more than 50% of late-stage emails focus on meeting schedules, the win rate drops by 50%:

Track and address low-velocity email when you see it in late-stage deals. But don’t stop there.

When you see deals with a high email velocity, don’t assume everything’s fine in the deal. Use revenue intelligence to dig a little deeper and ensure that your rep and the buyer haven’t fallen into a scheduling abyss. When that happens, it could be a signal that buyers aren’t as committed as you think. Double check that it’s truly a committed deal.

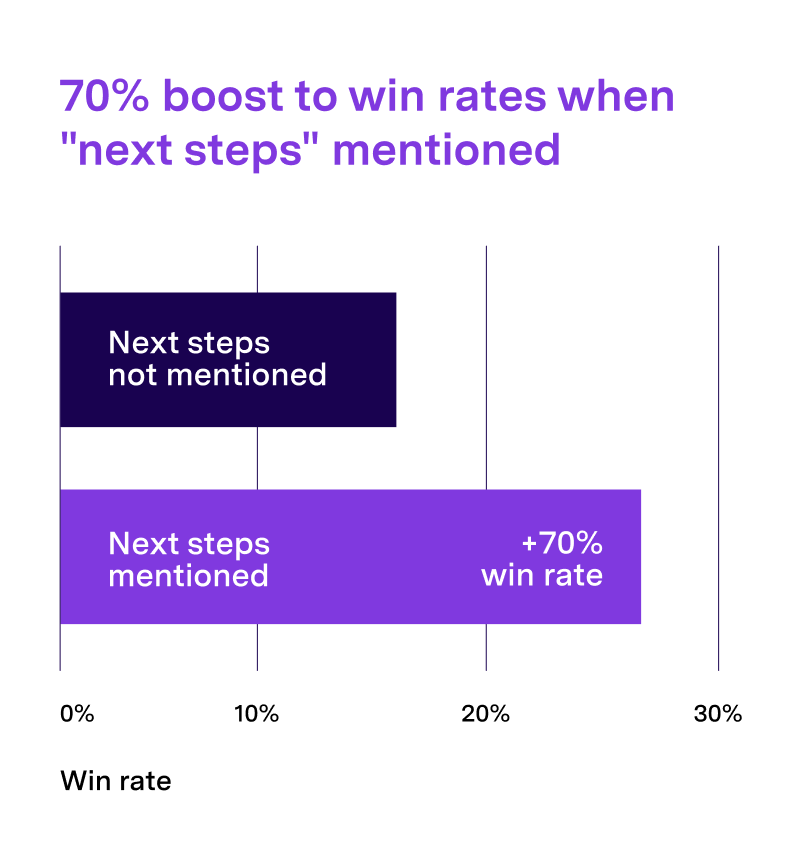

3. Next steps are critical to closed-won deals

Setting next steps in deals is essential.

After combing through 300+ deal signals related to deal health in nearly 30k calls, we can say definitively that reps who discuss next steps at any point in a deal have a 70% higher chance of closing than reps who don’t:

Without definitive next steps, deals can easily be forgotten and go stagnant. If that happens, there’s a real risk the deal will die on the vine.

Next steps drive deals toward the finish line and keep both buyers and sellers engaged in concrete actions. If you don’t see next steps set in a deal, it might not belong in your forecast.

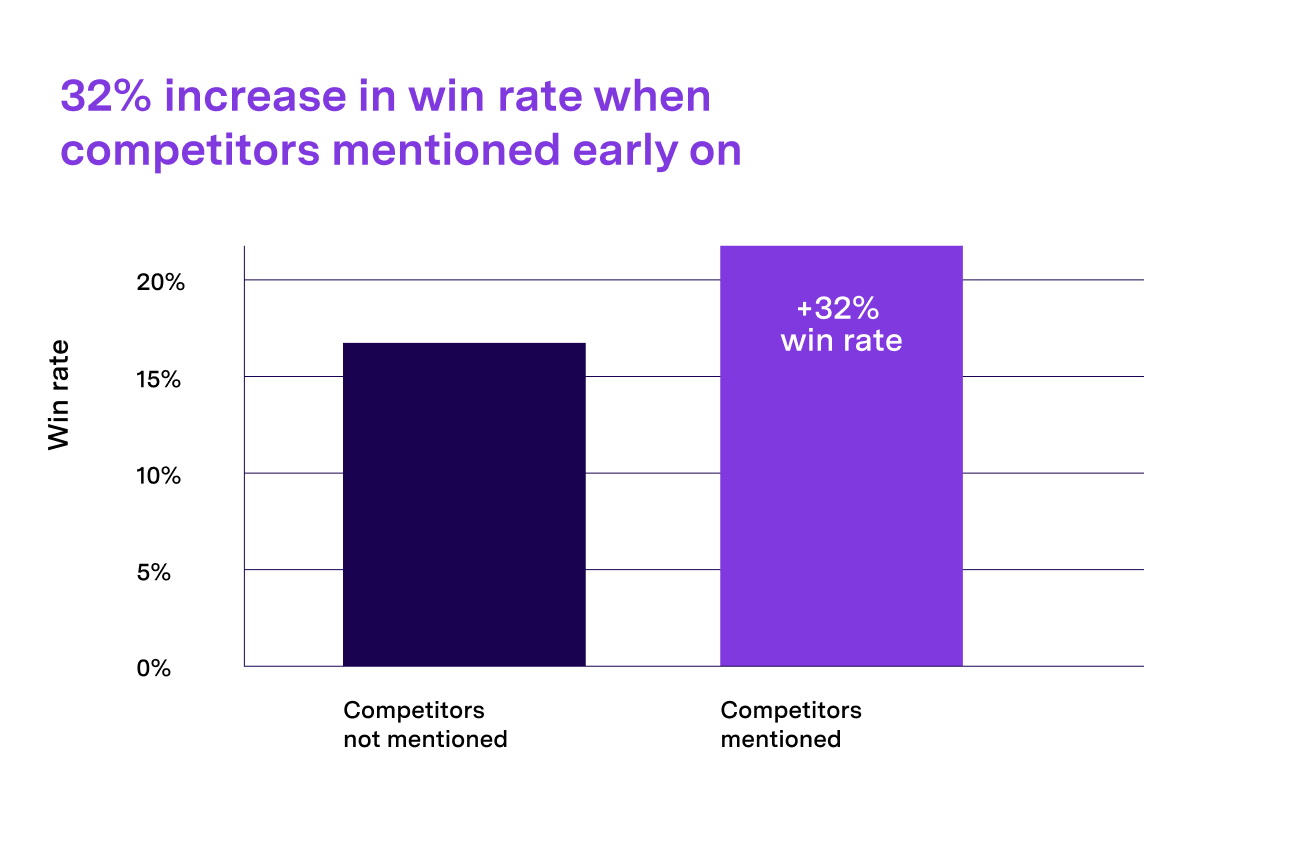

4. Pay attention to when the competition is discussed

Knowing when competitor discussions happen (or don’t happen) is key to understanding whether you’re heading toward a won or lost deal. Your forecast’s accuracy depends on that level of insight.

Early stage mentions

No one loves talking about the competition. But when they’re discussed early on, it’s a good thing. (Not so for late-stage mentions, but we’ll get there in a minute.)

Early mentions of the competition increase the odds of winning an enterprise deal by 32% over not discussing the competition:

When competitors are discussed early in the cycle, it’s a positive signal that the buyer has real intent to buy. Congrats! If they know other players in the space, they most likely are educated on your offering and understand the problem it solves.

Alternatively, if the competition isn’t mentioned early on, that could be a sign that the buyer isn’t actually serious… and that the deal might not belong in your forecast just yet. Drill down to assess what’s happening. If the competition wasn’t mentioned, have the rep ask about the buyer’s evaluation process. (Some reps use MEDDICC to ensure their pipeline is truly qualified.)

As we hinted at earlier, the positive effects of an early competitor mention don’t remain true throughout the deal cycle…

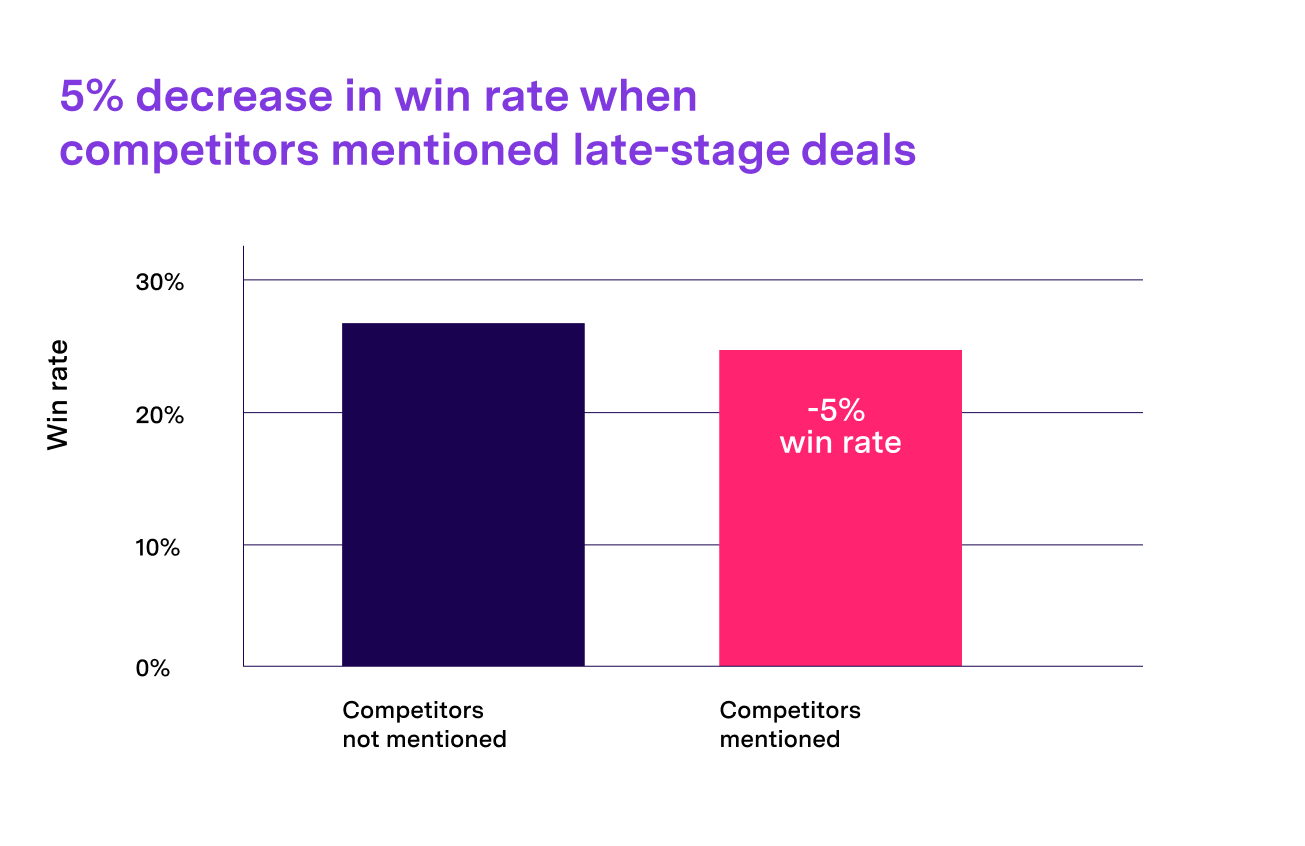

Late-stage mentions

If competitors are mentioned in the late stages of a cycle, the deal is under threat and the odds of closing the deal decrease:

If competitor discussions are still happening at this point in the deal, it’s time for the rep to uncover the source of the uncertainty. Is it something the rep can control for?

Until you have an answer, the likelihood the deal will close is lower, and you should account for that in your forecast.

Supercharge your forecast accuracy with deal scoring

These four deal signals represent the true health of your pipeline. Without them, you can’t pressure test your numbers or find and save deals at risk.

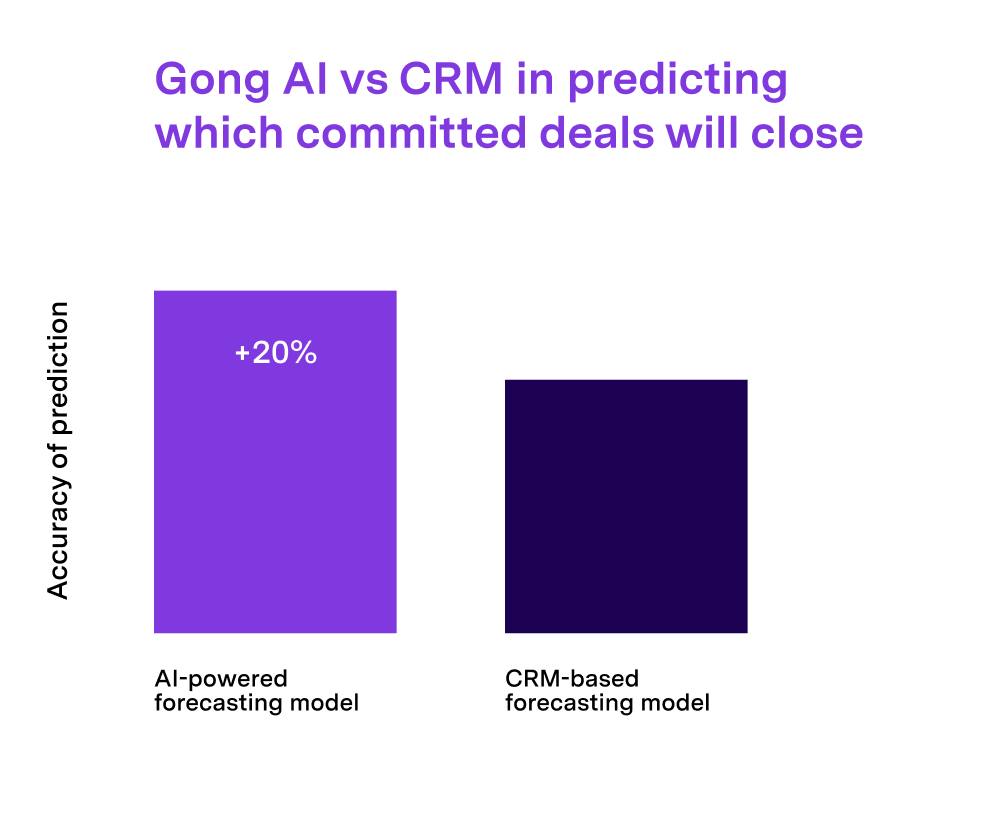

So how do you get this level of visibility when even the best CRM-based forecasting processes don’t highlight these deal signals? …And when platforms that rely on messy CRM data or off-the-shelf AI models don’t give you accurate deal insights?

Only a revenue platform that’s built on customer interaction data — and whose AI models are trained specifically for revenue teams — gives you the accuracy you need to inspect your pipeline, confidently call your number, and close more deals.

Gong Forecast’s new Deal Likelihood Score is based on 300+ buying signals from inside 2.5 billion customer conversations captured on the Gong Platform. This new feature outlines your chance of winning each deal in your pipeline using a “Low,” “Medium,” or “High” rating, and includes an explanation of the factors that contributed to that score. It’s information that’s easy to understand and act on.

The predictive AI behind our Deal Likelihood Score is so precise, it’s able to anticipate which deals in your forecast will close with 20% more accuracy than using CRM data alone (and with 22% more accuracy than reps’ predictions):

If you’re only looking at your CRM or relying on reps, expect a lower level of accuracy than you’d get with AI in predicting whether your committed deals will close.

With 300+ deal signals, including hundreds from outside your CRM, Gong’s Deal Likelihood Score enables the forecast accuracy you need (see it in action here).

Make confident predictions in any economy

Want to run reliable pipeline inspections and hit your forecast every time? Use Gong’s guide to “Achieving Revenue Predictability in Any Economy” here: