What’s the average SaaS churn rate, and how do you reduce it?

Every customer success manager knows that crushing, sinking feeling of a non-renewal. The disappointment of losing a client and offboarding their account never fails to sting.

Of course, churn is a natural part of every business. It simply isn’t realistic to expect every customer that signs up to stay with your company forever. But how much churn in SaaS is too much? And, how does your company’s churn rate measure up to your industry average?

This article will look at what a ‘normal’ churn rate might be for a SaaS company, how to reduce churn rates if yours are above average, what factors affect churn rates, and how companies can set and exceed strong SaaS churn rate benchmarks.

What is the average SaaS churn rate?

A question that every customer success manager asks is: “Do I have an average churn rate?” The even more important question is: “How can I lower my churn rate?”

A SaaS business’ growth depends on more than just increasing its buyer count. It is also important to keep customer churn rates low. To do that, they need to keep customer retention high and clients happy.

The typical SaaS churn rate is often cited to be around 5%. To have a good SaaS churn rate, you should aim for under 3% — though there’s more to this metric than meets the eye. Ultimately, understanding the nuances of your SaaS churn rate can mean the difference between stagnation and impressive growth.

Monthly churn rate vs. annual churn rate

First, it’s critical to understand that 5% is the average rate of annual churn, not monthly churn.

There’s a big difference between the two, and the numbers show why. If you start a month with 100 customers and end it with 95, you have a monthly churn rate of 5%. While this might not seem like much, what if you continued to lose customers at the same rate every month for a year? By the end of that year, you’d have 46 customers.

A good monthly subscription churn rate average is 0.40% or lower. Depending on whether you offer monthly plans alongside longer-period contracts, you should consider tracking both your monthly churn rate and your annual churn rate.

Customer churn vs. revenue churn

The next SaaS churn metric to be aware of is customer churn vs. revenue churn. That 5% average is the rate for SaaS customer churn. Total revenue churn is benchmarked a little higher.

It’s essential to know both your customer churn and your revenue churn. Let’s break down why.

Say you started the year with 500 customers and lost 15 by the end of it. Your customer churn rate would be a healthy 3%. But if those 15 customers accounted for 20% of your total revenue, you’d have a worrying revenue churn rate. Knowing your average revenue per user (ARPU) can help you find your average revenue churn.

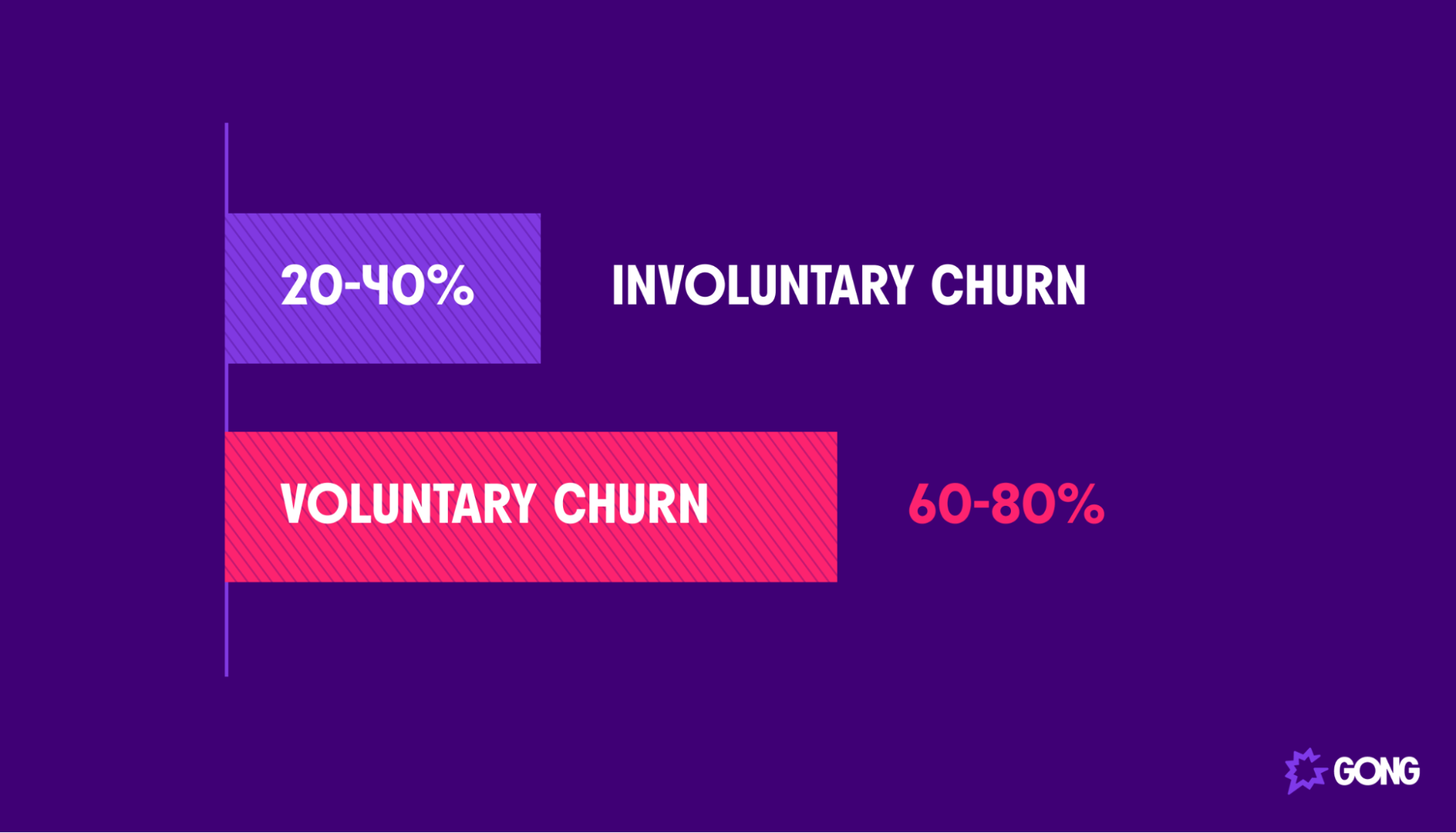

Voluntary vs. involuntary churn

The last SaaS churn metric to consider when tackling your churn strategy is the impact of involuntary churn.

On average, anywhere from 20–40% of churn is accidental or “involuntary.” Involuntary churn usually occurs due to credit card failure, incorrect payment details, or other payment issues. As a result, the buyer’s subscription is automatically canceled.

On the other hand, voluntary churn is when existing buyers knowingly cancel their subscription services. Voluntary churn can happen due to reduced budgets, changing needs, shifting priorities, or the worst-case scenario: buyer dissatisfaction.

The bulk of customer churn comes from voluntary churn. As such, it’s where you should focus most of your churn prevention efforts.

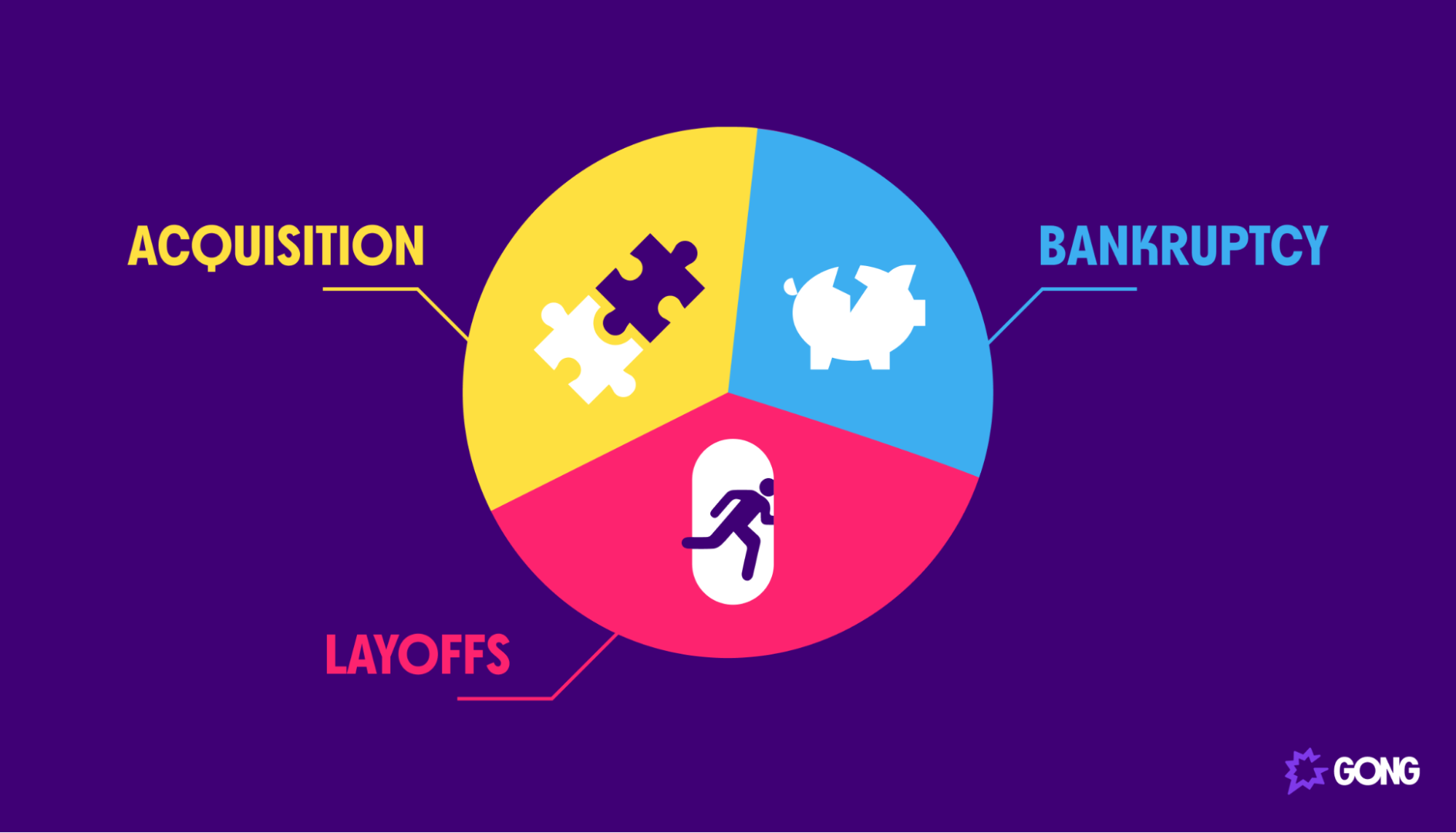

Is there such a thing as a good churn rate?

In an ideal world, all of your buyers would renew. However, we know that’s not possible. Some churn factors, such as acquisitions and layoffs, are out of your control.

- Acquisitions: In a B2B SaaS environment, if your client gets acquired by another company, it’s possible their parent company already has a competitor’s software. You can try to make them switch to yours, but their customer loyalty to their existing solution provider and other issues are often at play.

- Layoffs: Layoffs can also impact your customer churn rate. This is true for both B2B and B2C business model companies. A business may cut an entire team using a particular software and therefore no longer need it. Alternatively, a laid-off employee using your software to help them with their job will no longer need it and be looking to reduce spending.

We’d love it if buyers never had to cancel their SaaS subscriptions. You can and should aim to prevent churn whenever possible. At the same time, churn happens for many reasons entirely outside of your control.

That’s why it’s best to set clear, attainable targets for your SaaS churn rates and work on meeting them.

What factors impact average churn rate?

One company’s acceptable churn rate could be another company’s worrying SaaS metric.

Unique aspects of your SaaS company and its subscription business can affect your individual average churn rate. Here are some different reasons companies have varying churn rates and things to consider when analyzing your company’s SaaS churn rate benchmark.

B2B SaaS churn rates vs. B2C SaaS churn rates

B2B-style businesses generally experience lower churn than B2C companies. The average B2B churn rate is lower because companies purchasing decisions are more methodical and go through a longer buying cycle. Business purchases usually require several levels of approval and evaluate many software options before deciding.

That also means businesses are less likely to cancel and switch, certainly not without prior notice and conversations. B2B subscription models often have fewer customers, but they’re able to give them more attention. On average, B2B SaaS companies have lower average churn rates.

On the other hand, buyers of B2C SaaS products churn more often. This is partially due to involuntary churn — businesses keep a better track of their purchases than individuals — but also because individual buyers make more impulse purchases.

How SaaS company size impacts your average churn rate

A company’s average revenue can also impact its churn numbers. Companies with smaller revenue or a lower total number of customers often have a higher churn rate. This is especially true for revenue churn rates, as each lost customer accounts for a more significant percentage of your total revenue.

Larger companies often do that with more enterprise deals. Enterprise deals go through a significant and systematic buying process and are much less likely to churn. Small businesses that don’t yet have a stable customer base or significant revenue from enterprise deals will often see higher customer attrition levels. For SMBs and startup companies, tackling churn is even more critical as new customer acquisition is more challenging earlier in a company’s lifetime.

Churn rates by industry

The SaaS average churn rate that we identified earlier also doesn’t account for the nuances of the industry. What industry your SaaS company is in can also affect its churn rate, and these average rates can vary wildly. It’s important to understand the average churn rate for your specific industry, including the revenue and customer churn rate by industry.

Contract lengths affect retention rate

You shouldn’t overlook your company’s pricing model as a potential factor, either. Your customers being signed onto an annual contract or a monthly contract can also impact your churn numbers. Customers that are only signed up on a monthly contract are more likely to churn than those who are on an annual basis.

Having buyers commit to an annual contract has a positive impact on more than just the churn KPI. Annual plans can also give you more reliable monthly recurring revenue (MRR) and annual recurring revenue (ARR). An annual contract gives you more time to develop positive relationships with buyers and find opportunities for upsells.

Five actionable strategies to reduce your SaaS churn rate

1. Understand what’s driving churn

The first step to improving your churn rate is understanding what’s driving existing churn. Consider consulting with your revenue or sales operations team and analyzing your churn metrics over a given period.

Dig into why your customers churn on a more detailed level. Track all of your SaaS metrics and churn analysis somewhere your sales and customer success teams can access it. Then it’s time to make a list of things you could have done differently to keep those customers.

For involuntary churn, consider improving your payment failure notification processes or offering a more secure payment method. Customers should pre-emptively receive a warning that their credit card on file has expired or that their other payment method has failed. Your internal revenue teams should also be notified when payments fail and have an automated process in place to retrieve updated payment details.

To address voluntary churn, consider reinforcing objection handling or realigning what your target customer looks like and what your target market should be. If you don’t have existing answers to address your customer’s reasons for not renewing, offer some. Make sure your sales and customer success teams have the resources and information they need to answer any objections that might come up at renewal time.

Check out our objection-handling techniques for some ideas.

2. Onboarding and customer success can improve your retention rate

The importance of a good onboarding strategy can’t be overstated. Making sure customers get what they were looking for in their first year or even first month can have a massive impact on your net revenue churn and customer retention.

It’s also important to take this time to understand exactly why they bought your product, so you can anticipate when changing needs might arise. Knowing this information will help at renewal time as well. If a customer is questioning a renewal, going back to what they said during their onboarding will help you reinforce the original value-props that spoke to them.

Gong can support your customer success efforts by helping you track all of your customer conversations.

3. Identify and address churn indicators quickly

As a customer success manager, you have a unique ability to have frank conversations with clients. Don’t be afraid to ask direct questions and dig deep into any issues they mention, even small ones.

Keep track of any issues they have or concerns they mention. Escalate any major problems to product, support, or other operations teams. As always, follow up with your client to ensure their issues were successfully resolved.

Recognizing churn indicators early allows you to address them before they become big problems and hit your SaaS churn benchmarks.

4. Personalize your cancellation offers to reduce your churn rate

When a customer informs you they’re going to cancel, their mind might not be entirely made up. Whether buyers can cancel on their own or the buyer has to talk to the customer success team first, you should have cancellation offers ready to go.

Remember that keeping a buyer at a discount is always better than losing them. Retaining customers keeps your customer acquisition costs (CAC) low, and gives you a lower churn rate. Having a clear cancellation offer process allows your sales and customer success reps to communicate freely without having to get manager approval for offers.

Personalize your cancellation offers by revisiting the buyer’s reasons for purchasing in the first place. Go back to any support tickets or issues they mentioned. See if you can solve any pain points they have with your product by offering a feature outside their payment tier.

Be sure to understand fully why the buyer wants to leave and address that pain directly. If they still end up canceling, note the cause of non-renewal for future learning.

5. Use Gong to tackle your churn rate

Even the best customer success managers don’t eliminate churn all on their own. It’s hard to keep track of all the information your buyers have told you in your accounts.

That’s why you should use software like Gong to keep track of it for you. Gong helps customer success managers stay on track and reduce customer churn. By recording your customer conversations, you can rely on Gong’s infinite memory and keyword search capabilities to reduce customer churn.

Gong also uses automated analytics and customer success coaching to help you improve your retention rate over time and even achieve negative churn. To see it in action, book your demo today.

Take control of your SaaS churn rate

Churn is the unavoidable thorn in the side of any customer success manager. To create a strategy that’ll shave percentages off your SaaS churn rate, you need to properly understand what kind of churn you have and the causes of it.

From there, you can build a customer success strategy that gets ahead of churn indicators and takes quick action to prevent churn where possible.

To do it all, you need software that can meet the demands of your ambitious strategy. Gong can help you track churn indicators and analyze all of your customers’ interactions to mitigate and even prevent churn. With easy integrations to all your existing apps, Gong works with you to grow your SaaS company and hit your targets.

Get started with Gong and book a demo today.