Customer churn operates as a hidden adversary. While complete elimination may be a lofty goal, even a modest reduction can significantly bolster your bottom line.

The key lies in the ability to identify at-risk accounts as early as possible. To achieve this, you’ll need a structured process and a predictive tool for churn analysis.

In this article, we’ll discuss what to look for when predicting customer churn, outline the methods for doing so effectively, and provide guidance on how to respond when you identify at-risk accounts.

A quick customer churn recap

Customer churn, also known as customer attrition, is the rate at which your company loses customers. Some amount of churn is inevitable, but sudden and unexpected spikes in customer attrition can severely impact your bottom line. High churn results in a lost revenue source and the need to increase investment in acquiring new customers.

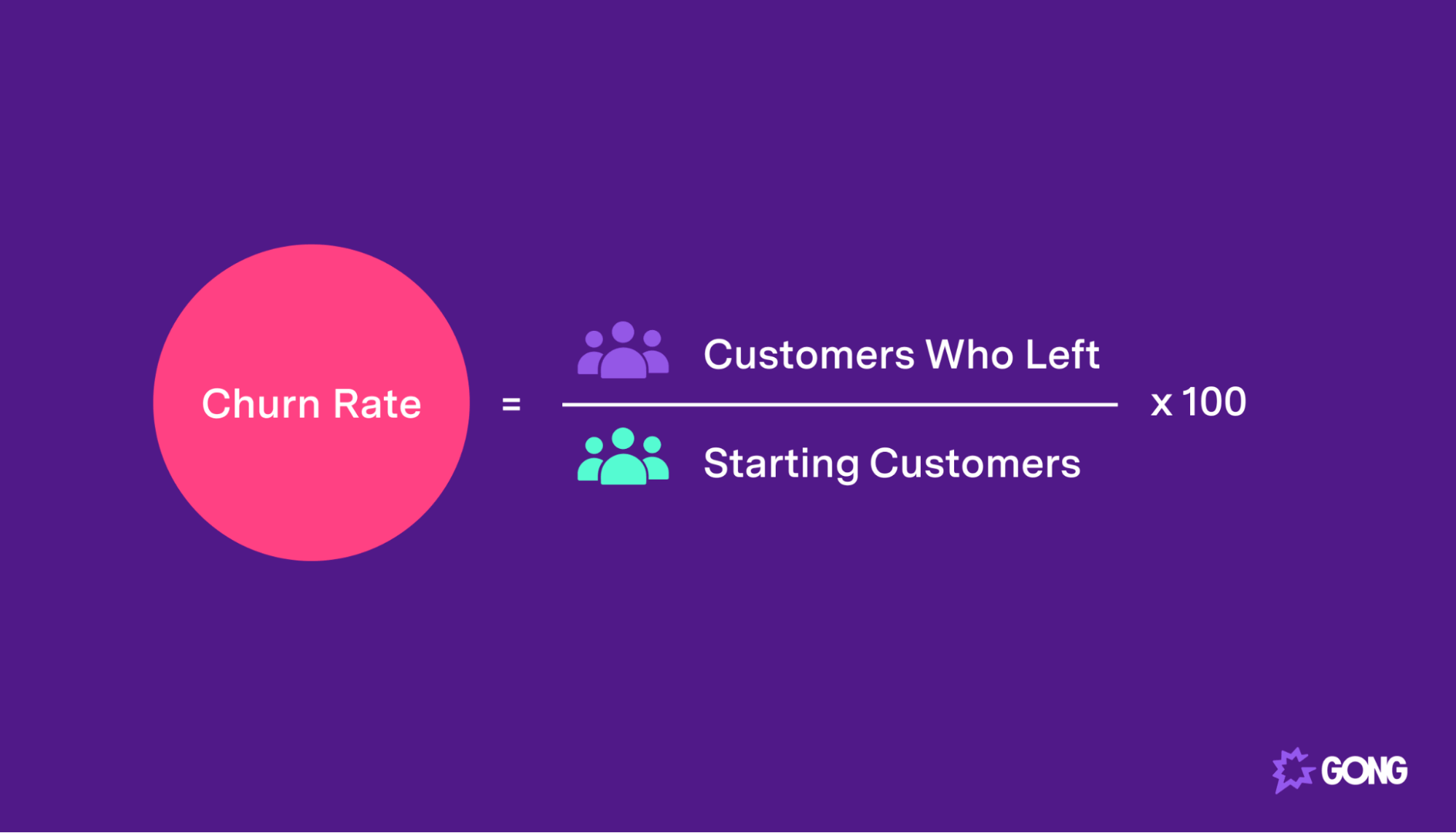

You need to know how to calculate churn rate to predict and account for it. Luckily, it’s a simple equation:

Your customer churn rate is the number of customers who left your business over a given period divided by the number of customers you had at the beginning of that period, multiplied by 100.

You also need to know the most common reasons for customer churn. There are several culprits, including:

- Poor product-market fit – your product doesn’t solve a pain point for customers and they aren’t satisfied with it.

- A bad onboarding – if customers don’t get help setting up a tool, they may struggle to see a return on their investment.

- Poor customer service – just one instance of bad customer service can be enough to send customers into the hands of competitors.

- A bad sales process or marketing strategy – targeting the wrong prospects can result in poor product-market fit.

- Perceived low ROI – customers may cancel if they don’t think their results warrant the investment.

Why is predicting churn so important?

Predicting customer churn is crucial for businesses because it allows them to take proactive measures to retain their customer base and improve their bottom line.

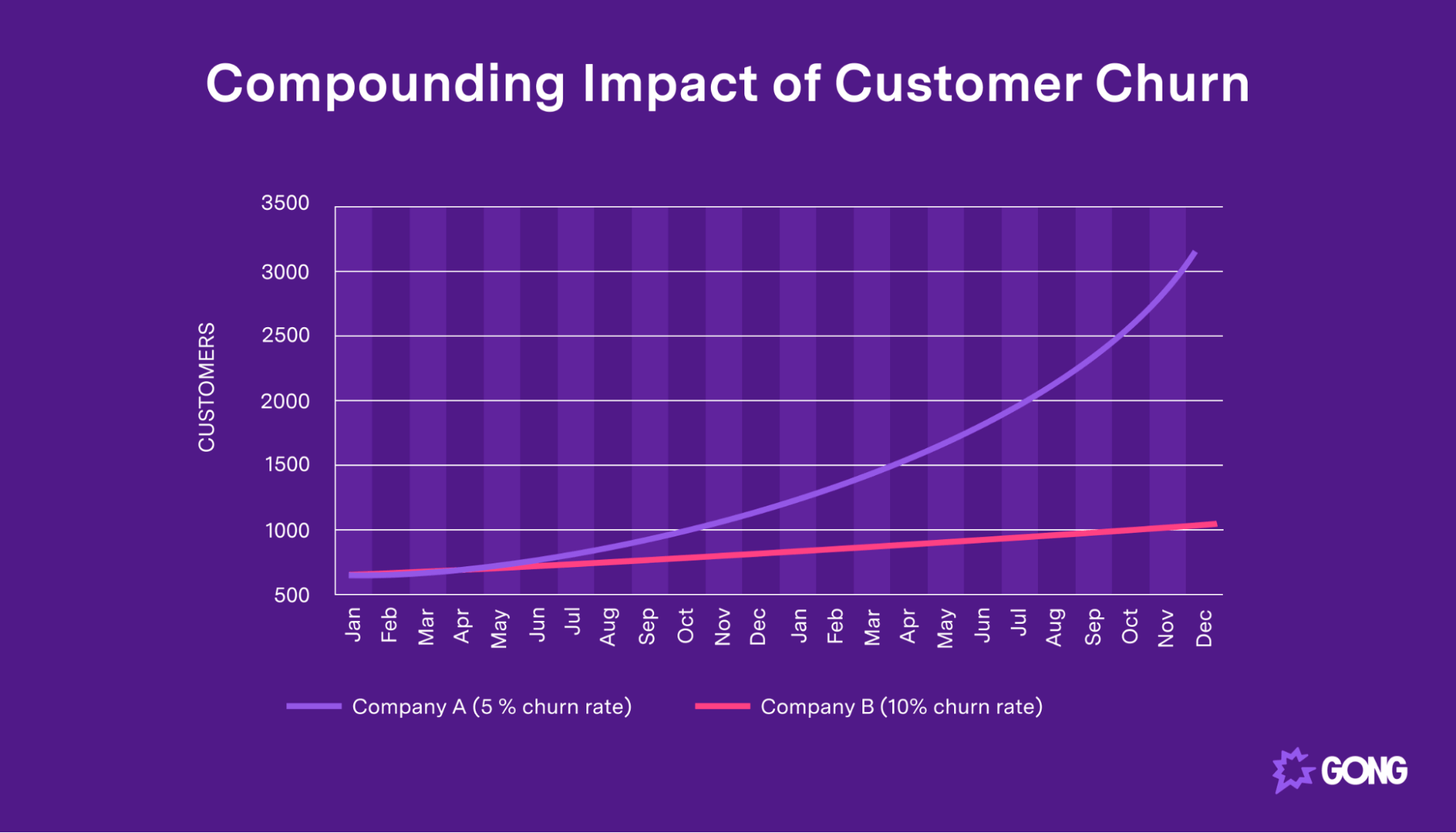

As discussed above, churn can have a big impact on business since it results in lost revenue and increased costs to acquire a new customer. Just take a look at the example below to see how big an impact churn rates can have.

Take two companies, A and B. If both companies acquire new customers at a rate of 15% per month, but company A has a 5% churn rate and company B has a 10% churn rate. In just two years, Company A will outgrow company B by over 500%.

By honing in on specific customers that are at risk of churning, you can take steps to prevent them from leaving. This will typically take the form of retention strategies like discounts or loyalty rewards.

Churn prediction also lets executives analyze the health of their company’s sales and customer success processes. High churn rates can signify a problem with sales or onboarding strategies, but they can also indicate broader issues with your product or service. It’s only by predicting and analyzing churn that you can take steps to fix these issues.

Customer chun prediction: how to predict it

There are several ways to predict customer churn ranging from customer surveys to behavioral analysis and predictive analytics.

While the first two certainly have their place, we believe artificial intelligence algorithms should be the first port of call for any company serious about predicting customer churn. That’s because predictive analytics makes predictions based on a range of data sources and a combination of historical customer data and real-time customer data.

SaaS businesses with data science teams can build their own customer churn prediction models. Obviously, not every company has those resources. Luckily, there are several revenue intelligence platforms, like Gong, that record historical data points, combine them with current activity metrics, and then use a machine learning model to analyze that data and predict customer churn.

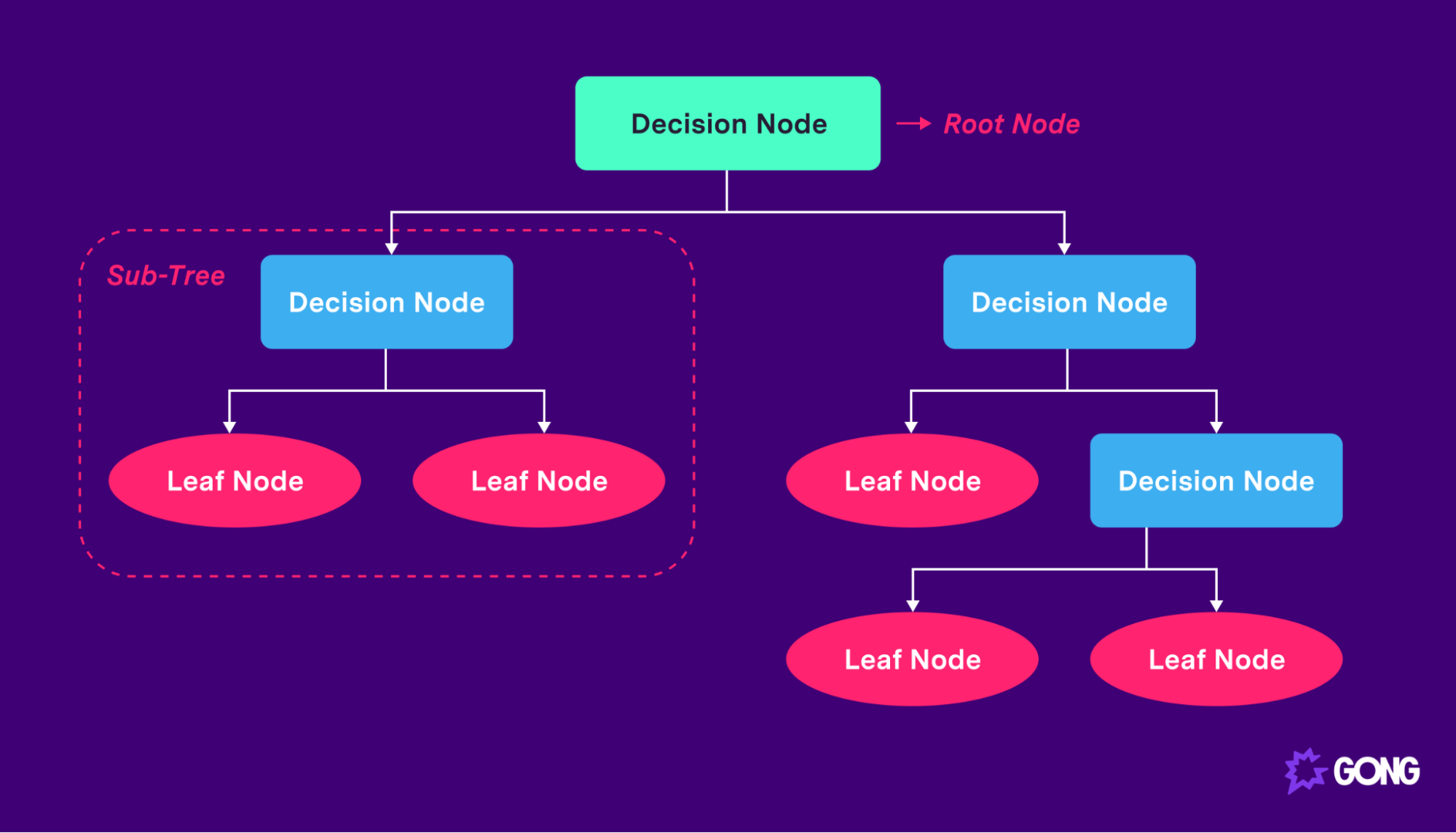

There are different ways to predict churn, but the most popular are the decision tree, logistic regression and random forest churn prediction models.

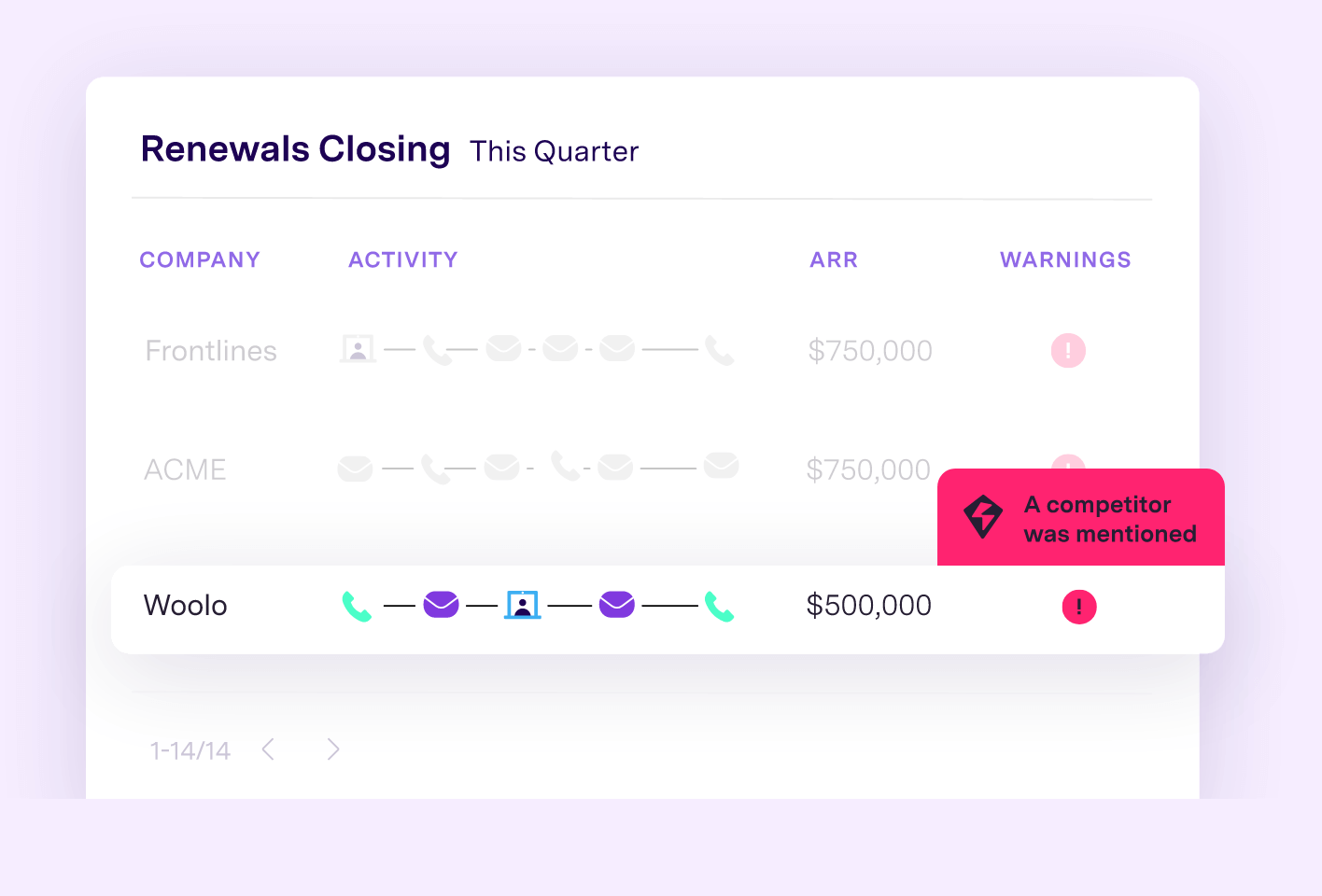

This predictive model, shown above, is trained on various data sets to understand what factors make a customer more likely to churn.

Specific actions — like reduced activity levels or mentioning a competitor during a customer call — can be labeled as risk activators and red flag metrics. The more of these red flags that a user account creates, the more likely they are to churn.

How to make churn forecasting more accurate

Integrating tools like Gong into your tech stack aside, there are several other strategies you can use to improve the accuracy of churn forecasting.

Define what churning means

The first step to creating an accurate churn forecasting model is to define exactly what churn means to you. It could be an app uninstall, a canceled subscription, or something else entirely. But it’s only by clearly defining how a customer churns that you can start to predict it.

Segment your customers

One of the best ways to predict customer churn is to identify patterns. And the best way to identify patterns is to segment your customers in just about any way you can. That can include segmenting them by:

- Size

- Industry

- Contract type

- Subscription date

- Location

- Goal

If you can find one segment of your customers that churns more than others, you’ll be able to more accurately forecast customer churn rates of future clients using this information.

Measure customer satisfaction

Unhappy customers become churners. So it’s important to identify just how happy your customers are and which segments of them, if any, are unhappier than others.

There are several KPIs and metrics you can use to measure customer satisfaction. These include:

- CSAT

- NPS

- MAU

- License utilization

- Customer health

Net Promoter Score (NPS) is one of the most valuable customer satisfaction metrics and is simply the process of asking how likely customers are to recommend you on a scale from 1-10. People who score you a 9 or 10 are promoters — anyone who scores you a 6 or below is a detractor. You then calculate NPS by subtracting the percentage of detractors from your percentage of promoters. Scores between 30 and 70 are considered good.

It’s not just about identifying customers that are unhappy right now, although a customer satisfaction survey will certainly do that. Measuring customer satisfaction in the long term will help you track to what extent changes to your sales process or product are having an impact on customer satisfaction levels and therefore retention rates. If customers are getting happier and retention rates are falling, you’re on the right track.

Track customer behavior

Do you know which customers are likely to churn? The ones who use your product the least. That’s why carefully tracking customer behavior can help you accurately forecast churn.

There are several ways you can use customer behavior to predict churn. The first is simply to look at the time since a customer’s last activity. The longer a customer has been away from your tool, the more likely they are to churn.

You can add more context to that KPI by considering a customer’s activity rate. For instance, customers who have been very active and suddenly disappeared may be a bigger cause for concern than customers who only use your tool infrequently.

How to reduce churn

Predicting customer churn is only useful if you are prepared to take a targeted approach to increase retention. So once you’ve predicted which customers are at risk of leaving, use the following four strategies to reduce churn.

1. Get ahead of the conversation

Don’t just forecast the number of customers who are likely to churn this month — use a tool like Gong to identify the specific customers who are at risk of leaving. Gong analyzes customer conversations and behavior to look for signs of churn and then uses the prediction methods described above to accurately highlight at-risk accounts.

Once you identify who these customers are, make sure customer success teams are reaching out to them directly. In some cases, avoiding churn may be as simple as resolving a minor support issue. In others, it can be a completely new sales event that requires careful decision-making, ROI, pain points, and other factors.

The latter requires more work and a different approach, but you won’t know until you reach out to them.

2. Help customers to improve ROI

One of the most common reasons customers churn is because they are failing to find value from your product. Make it your onboarding and customer success teams’ goals to help existing customers find a return on their investment as quickly as possible.

A good onboarding solution is invaluable in this regard. So are other unpersonalized strategies like email campaigns that communicate new feature launches or discuss particular product features in detail.

A more personalized approach to communicating value can also be powerful. For instance, customer success teams can send emails to customers who aren’t logging in often, asking them how they can help.

3. Frame renewal to avoid change

When you’re making sales, change is your friend. You want to challenge the status quo and shake things up by introducing your product or service. After all, what they’re doing isn’t working — that’s why they need your product.

But it’s the opposite when it comes to renewals. In this case, the status quo is your friend. Change isn’t good.

One way to frame renewals in this way is to make customers aware of everything they stand to lose by leaving your product. Not just the features and tools they have access to, but all of the benefits they currently enjoy. During the cancellation process, highlight the fact that customers save X many hours by using your tool or X number of dollars compared to hiring someone in-house. Loss aversion is a powerful motivator and it could be enough to reduce churn.

4. Analyze churned accounts

You won’t stop everyone from churning. Some amount of churn is inevitable, but that doesn’t mean those ex-customers are useless. Analyze churned accounts to identify what they have in common.

Often, churning customers will be more than happy to tell you what went wrong. Add customer feedback forms to the cancellation process to collect qualitative and quantitative data that you can use to improve your product and customer experience going forward.

For instance, churn analysis can help sales teams fine-tune their customer personas to better target prospects who are less likely to churn. It can also help product teams prioritize features that churned customers say are lacking.

Conquer customer churn predication with Gong

Accurately predicting churn is essential if you want to achieve your company’s revenue goals. By predicting churn, you can improve several areas of your business — from your product through to your sales process — and take actionable steps to reduce churn.

Gong is the perfect partner in your quest to fight churn. Our machine learning customer success software makes it easy to identify at-risk accounts. Book a demo today to find out more.