Executive insights

3 proven ways to book your next executive meeting

Dan Morgese

Director, Content Strategy and Research at Gong

Published on: February 5, 2026

This article is part of a special Gong x 30 Minutes to President's Club x DemandJen executive selling and multithreading series as a sneak peek of our Selling to The C-Suite course. If you want to close bigger deals at the executive level, join here today.

Securing a second call after discovery with an executive is never guaranteed, and most reps don’t realize they’ve already lost it before the call even ends.

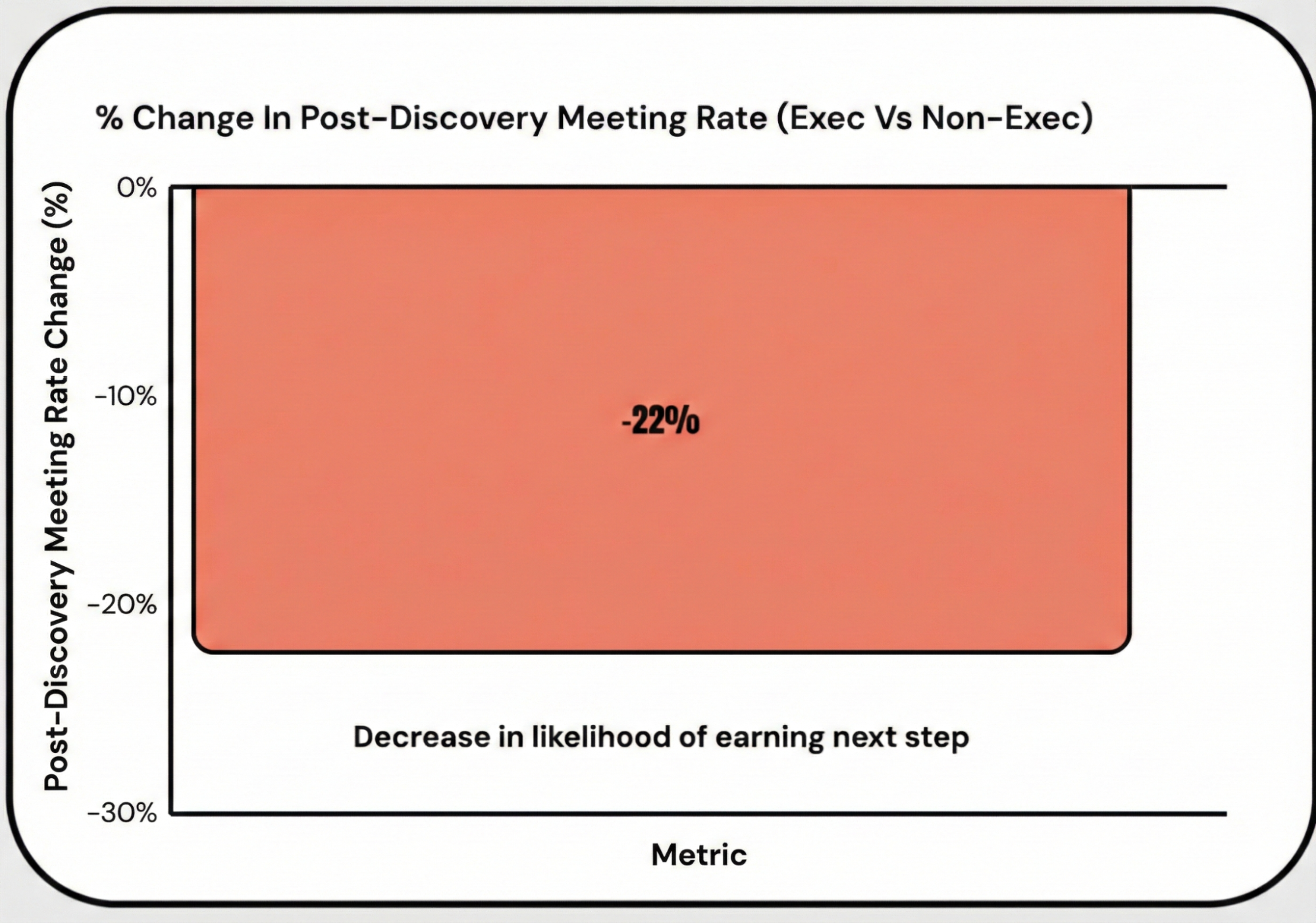

In fact, Gong data show that you’re 22% less likely to earn a next step with an executive compared to a non-executive after a discovery call:

That’s not because executives are harder to sell to, but because most reps treat executive discovery calls the same as any other. They pepper executives with tactical questions, rely on generic slide decks, and start pitching solutions too early.

As a result, the conversation feels noisy, generic, and not worth an executive’s time.

So, how do you actually run a discovery call that earns an executive’s respect and a second meeting?

We analyzed 1M+ executive sales cycles in partnership with Gong and Jen Allen-Knuth (Sold $50M+ in enterprise sales, ex-Challenger) to learn exactly what it takes to run a successful discovery call with an executive.

Below, we break down the data and tactics behind crushing executive discovery in three sections:

- The exact amount of time you should spend building rapport

- Why the best reps talk less than you think

- What happens when you talk about ROI and solutions

And if you like this, you’ll love the Ultimate Multithreading and Selling to the C-Suite Report, which includes more than 20 insights on how to close bigger deals with executives.

1. The exact amount of time you should spend building rapport

An executive’s calendar is often booked back-to-back, leaving many sellers unsure how much time to devote to rapport. Some default to small talk; others skip rapport entirely and jump straight into business.

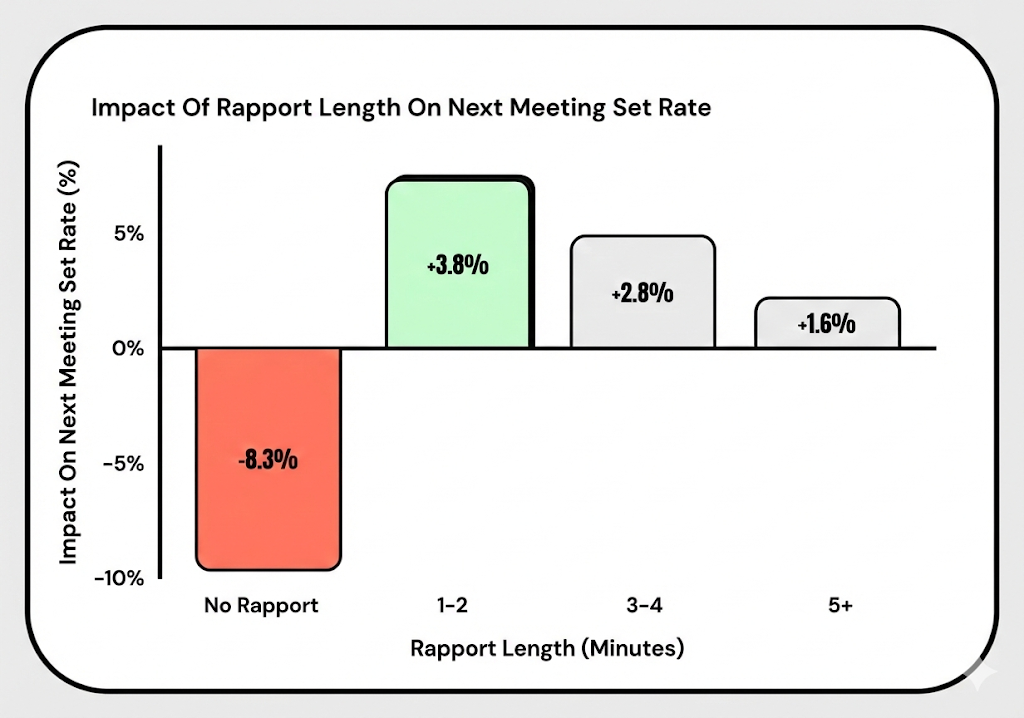

The data show that neither of those extremes actually works. Skipping rapport can reduce next meeting set rates by up to 8.3%, while spending just 1 to 2 minutes on rapport increases them by 3.8%. The difference is how that time is used.

Jen sees this play out constantly in executive conversations. The reps who earn second meetings don’t use rapport to be likable; they use it to establish relevance. Effective rapport with executives is not about weekends or weather — it’s about their business.

Here’s the exact talk track Jen uses to build rapport with executives:

“Before we get too far into the conversation, mind if I share what I learned about your firm? I don’t want to assume I have all the right answers just because I researched your company beforehand.

(Share research here)

What did I get wrong?”

When rapport reinforces credibility instead of filling space, it earns attention rather than wasting time.

2. Why the best reps talk less than you think

Reps often approach discovery like they’re playing a game of 20 questions. The result is a one-sided interrogation that executives quickly tune out of. In reality, the top reps ask fewer questions on discovery calls. In fact, a previous Gong Labs study uncovered that asking too many questions correlated with lower win rates.

That’s not because executives don’t want to answer questions. It’s because a high volume of generic, scripted questions signals low preparation and weak perspective.

Jen avoids prompts like “What’s the top priority for the business?” or “What’s challenging about that?” because they’re too generic — they make you sound like any other salesperson. Instead, she leads with context before asking a question, so it feels like a conversation, not an interview. For example:

Business priorities: “I don’t work within your four walls, but it seems like ACME is focused on X. I thought it might be because of Y. What did I get wrong?”

Challenges: “One of the things we hear that makes that tough is X. How is that different from what you’re seeing?”

By grounding questions in research and social proof, you can ask fewer questions and get far better answers because showing credibility builds trust with executives.

That’s what moves you out of the “scripted salesperson” bucket and gets executives to open up with the context you actually need to position your solution later.

3. What happens when you talk about ROI and solutions

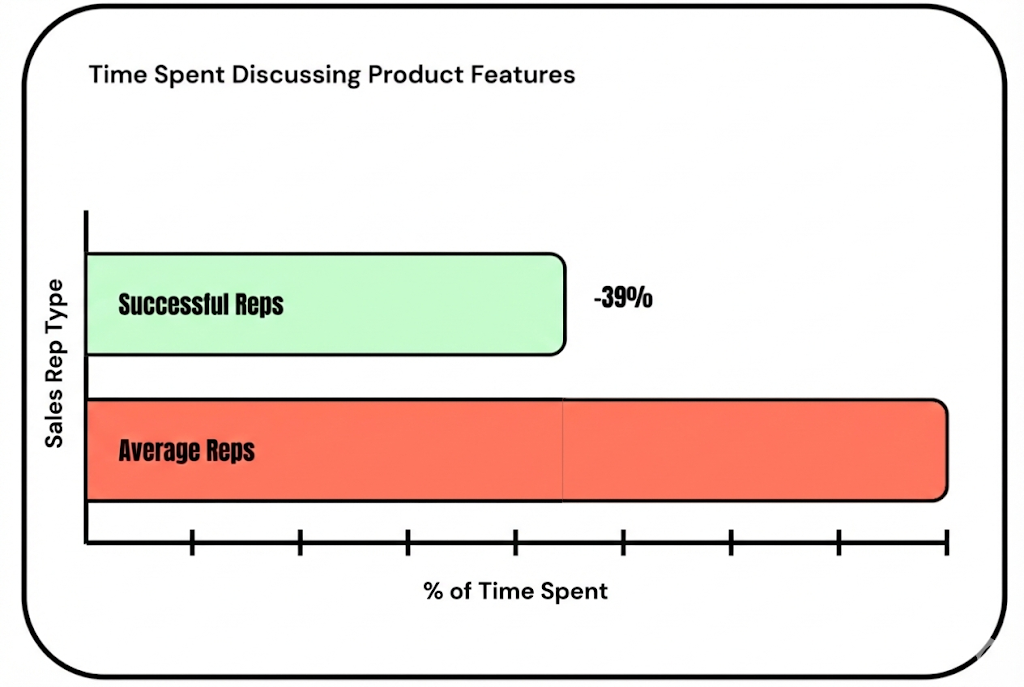

Reps often spend a large portion of discovery uncovering an executive’s priorities, then immediately pivot to pitching their product. But according to the data, reps are more likely to earn a next step when they limit how much they talk about their solution during discovery.

That’s because it’s nearly impossible to fully understand an executive’s business, initiatives, and challenges in a single call, making any early recommendation feel premature. Instead, treat discovery as the place to understand the problem, not solve it.

Rather than pitching, Jen uses this time to understand how the executive is solving the problem today, setting up her solution as a thoughtful alternative later in the process:

“Often, the way other firms address that is by XYZ, because of ABC. How is that different from how you’re addressing it today?”

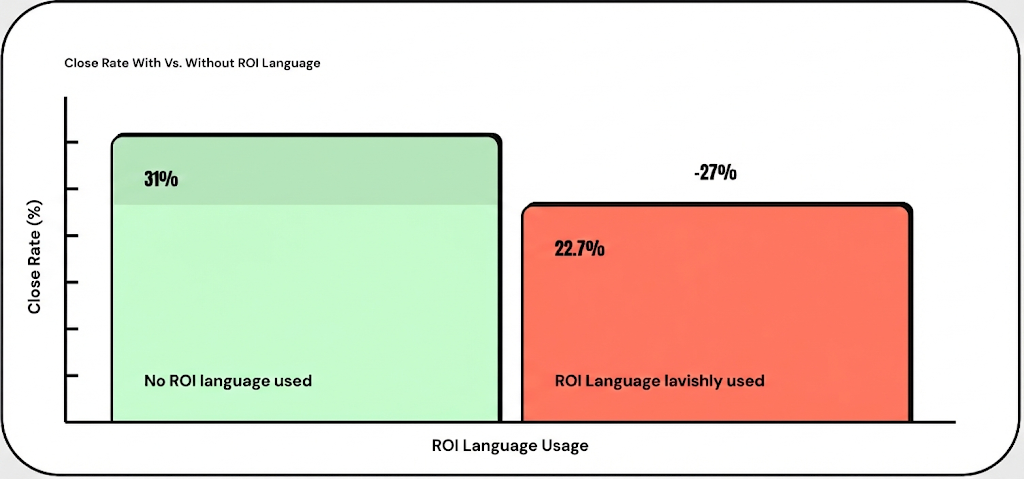

The same dynamic applies to ROI. Mentioning ROI at all during discovery correlated with lower next-meeting set rates with executives, because early ROI talk forces assumptions before the executive has fully aligned on the problem. Rather than signaling value, inflated numbers introduce uncertainty and skepticism.

Jen does the opposite. She avoids ROI entirely and focuses on the cost of inaction (COI). ROI is the return if you decide to buy something, while COI is the cost of not doing anything at all.

The easiest way to calculate COI is to use an industry peer as a benchmark, like in these examples:

- Recap the problem: It looks like there is a budget deficit of $X for the city of X. With tightening budgets, many other city officials are looking for ways to increase productivity of their IT teams without increasing headcount.

- Cite a peer benchmark: City of Philly is using AI to predict wifi downtime and resolve it remotely before the downtime event happens. This reduced their onsite visits by X% and achieved X% downtime events.

Now the executive realizes they’re leaving a 50% reduction in downtime on the table, which is something that we can formally quantify later in the sales cycle.

Executive discovery is harder than manager-level discovery, but leading with credibility, anchoring on strategic objectives, and staying client-focused dramatically increase your chances of earning a second meeting.

Want more? The Ultimate Multithreading and Selling to the C-Suite Report breaks down exactly how top reps win more (and bigger) executive-level deals.

Follow Gong on LinkedIn and subscribe to the Gong Labs newsletter for data-backed sales insights that help you close more deals.

Director, Content Strategy and Research at Gong

For over a decade, Dan has provided revenue leaders with data and insights to inform and execute their GTM strategies. As a former analyst at Forrester Research, he worked with hundreds of B2B organizations to measure and improve sales productivity.

Win more with Gong

Loading form...

Discover more from Gong

Check out the latest product information, executive insights, and selling tips and tricks, all on the Gong blog.